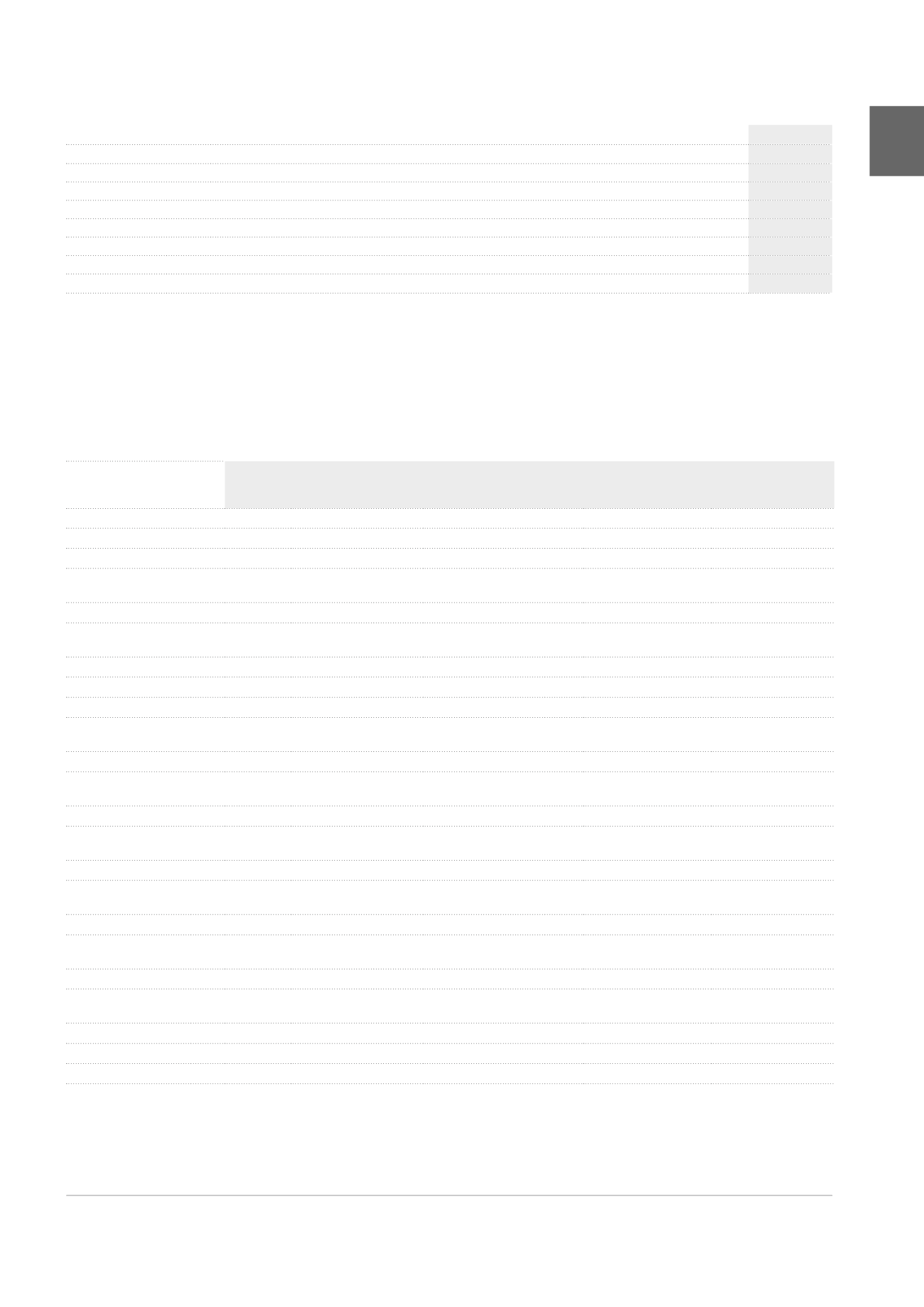

Changes in the fair value of investment properties, based on unobservable data

(x 1,000 EUR)

FAIR VALUE AT 31.12.2014

3,199,183

Gains/losses recognised on the income statement

-4,026

Acquisitions

74,793

Extensions/Redevelopments

27,552

Investments

24,117

Writeback of lease payments sold

10,214

Disposals

-197,480

FAIR VALUE AT 31.12.2015

3,134,353

Quantitative information related to the determination of the fair value of investment properties,

based on unobservable data (level 3)

1

Net rental income is incorporated in Note 6.

2

In 2015 and 2014, because of the very small size of the healthcare portfolio in Germany, the assumptions used for Germany were grouped together with the Netherlands.

3

The costs necessary for the completion of a building are specific to each project and depend on its degree of progress.

(x 1,000 EUR)

Asset category

Fair value

31.12.2015

Valuation method

Unobservable data

1

Extreme values

(weighted average) at

31.12.2015

Extreme values

(weighted average at

31.12.2014

HEALTHCARE REAL ESTATE

1,328,287

Belgium

770,420 Discounted cash flow

Estimated Rental Value (ERV)

70 - 199 (129) EUR/m²

64 - 187 (121) EUR/m²

Discount rate 6.20% - 6.90% (6.45%) 6.80 % - 7.30 % (7.00 %)

Capitalisation rate of the final

net ERV

7.00% - 9.25% (7.80%) 7.00 % - 9.25 % (7.82 %)

Inflation rate

1.75%

2.00 %

Discounted Estimated

Rental Value

Estimated Rental Value (ERV)

53 - 375 (137) EUR/m²

53 - 187 (123) EUR/m²

Capitalisation rate 5.60% - 7.25% (6.06%) 5.60 % - 7.25 % (6.21 %)

France

378,824 Discounted cash flow

Estimated Rental Value (ERV)

53 -260 (148) EUR/m² 53 - 280 (143) EUR/m²

Discount rate

5.50% 5.75 % - 7.50 % (5.79 %)

Capitalisation rate of the final

net ERV

5.35% - 12.31% (6.40%) 5.75 % - 12.31 % (6.71 %)

Inflation rate 0.65% - 1.92% (1.50%) 1.25 % - 2.05 % (2.02 %)

Discounted Estimated

Rental Value

Estimated Rental Value (ERV)

53 -260 (147) EUR/m²

53 - 280 (141) EUR/m²

Capitalisation rate 3.93% - 30.04% (7.26%) 3.81 % - 26.95 % (7.11 %)

Netherlands and

Germany

2

166,323 Discounted cash flow

Estimated Rental Value (ERV)

177 - 231 (209) EUR/m² 101 - 180 (148) EUR/m²

Discount rate 7.20% - 8.35% (8.05%) 7.25 % - 7.30 % (7.27 %)

Capitalisation rate of the final

net ERV

6.95% - 7.45% (7.18%) 7.00 % - 11.68 % (9.72 %)

Inflation rate

1.80% 1.80 % - 2.00 % (1.92 %)

Discounted Estimated

Rental value

Estimated rental value (ERV)

78 - 256 (174) EUR/m² 87 - 235 (158) EUR/m²

Capitalisation rate 5.00% - 7.50% (6.61%) 5.30 % - 7.50 % (6.51 %)

Healthcare real estate

under development

12,720

Residual value

Estimated Rental Value (ERV)

73 - 160 (117) EUR/m² 80 - 202 (170) EUR/m²

Capitalisation rate 6.00% - 12.25% (8.91%) 5.70 % - 14.26 % (7.65 %)

Costs to completion

3

3

Inflation rate 1.50% - 1.92% (1.69%) 1.50 % - 1.92 % (1.83 %)

The quantitative information in the following tables is taken from the

different reports produced by the independent real estate experts.

The figures are extreme values and the weighted average of the

assumptions used in the determination of the fair value of investment

properties. The lowest discount rates apply to specific situations.

179