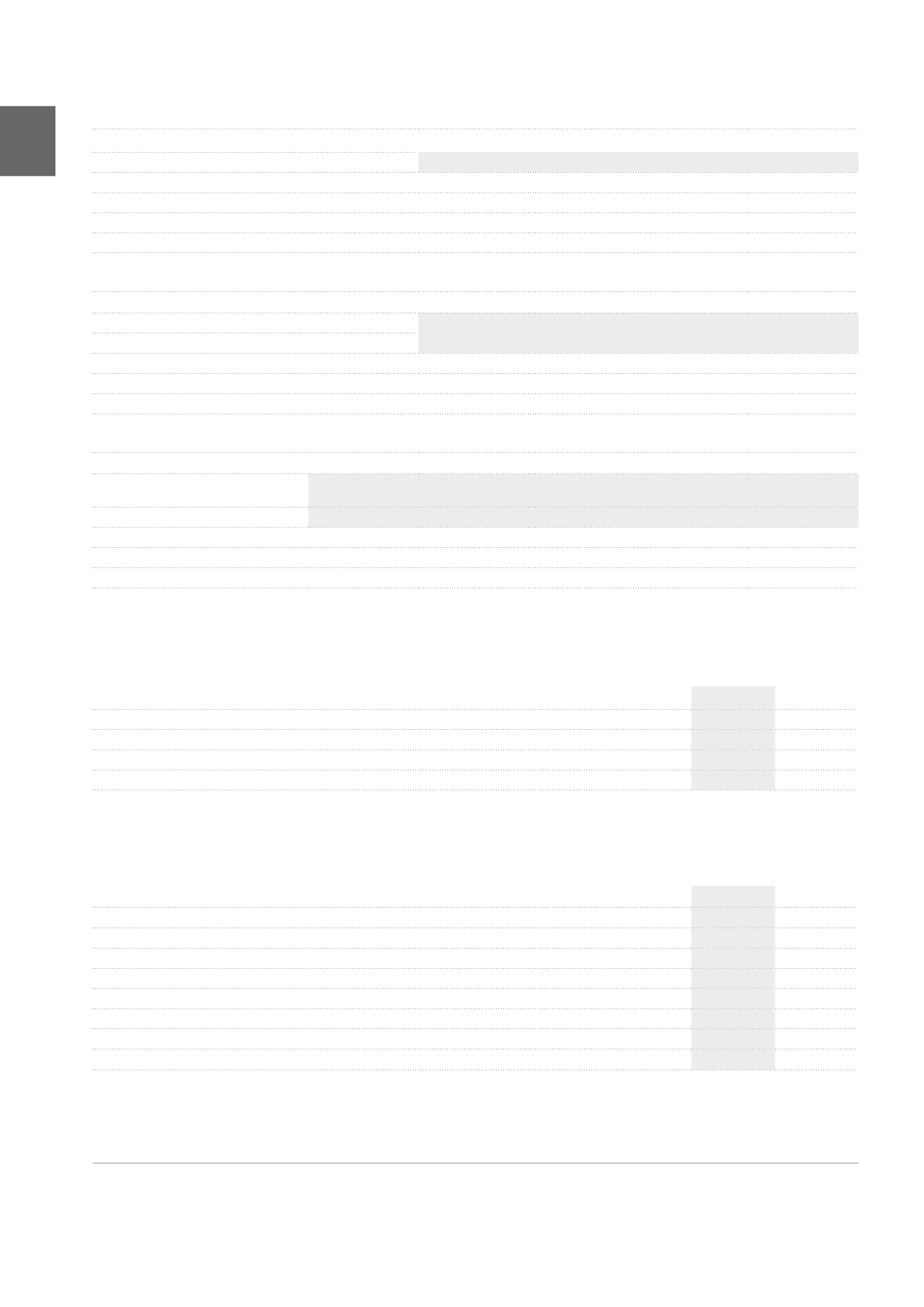

Properties available for lease

(x 1,000 EUR)

2015

2014

AT 01.01

3,097,932 3,199,030

Capital expenditures

16,685

15,240

Acquisitions

68,635

66,693

Transfers from/to Development projects

49,381

73,648

Sales/Disposals (fair value of assets sold/disposed of)

-177,878

-272,274

Writeback of lease payments sold and discounted

10,214

15,931

Increase/Decrease in the fair value

5

-3,655

-336

AT 31.12

3,061,314 3,097,932

NOTE 21. INVESTMENT PROPERTY

(x 1,000 EUR)

2015

2014

Properties available for lease

3,061,314

3,097,932

Development projects

61,544

88,966

Assets held for own use

8,625

8,875

TOTAL

3,131,483

4

3,195,773

The fair value of the portfolio, as determined by the independent experts, stands at 3,134,353 K EUR at 31.12.2015. It includes investment properties

for 3,131,483 K EUR and assets held for sale for 2,870 K EUR.

Impairment of goodwill

(x 1,000 EUR)

Building group

Goodwill

Net book value

1

Value in use

Impairment

Pubstone Belgium

55,777

330,073

325,273

-4,800

Pubstone Netherlands

35,650

182,767

180,467

-2,300

CIS France

26,929

229,635

229,635

2

TOTAL

118,356

742,475

735,375

-7,100

Sensitivity analysis of the value in use when the main variables of the impairment test vary

Change in the value in use (%)

Building group

Change in inflation

Change in the discount rate

+0.50%

-0.50%

+0.50%

-0.50%

Pubstone Belgium

5.70%

-5.29%

-5.51%

5.98%

Pubstone Netherlands

5.55%

-5.16%

-5.38%

5.83%

CIS France

7.34%

-6.69%

-6.44%

7.12%

Sensitivity analysis of the impairment when the main variables of the impairment test vary

Impairment

3

(x 1,000 EUR)

Building group

Impairment loss

recognised

Change in inflation

Change in the discount rate

+0.50%

-0.50%

+0.50%

-0.50%

Pubstone Belgium

-4,800

0

-22,033

-22,723

0

Pubstone Netherlands

-2,300

0

-11,637

-12,030

0

CIS France

0

0

0

0

0

1

Including goodwill.

2

Given that the value in use is greater than the net book value, we incorporate the net book value here.

3

The value of 0 was indicated when the value in use is greater than the net book value.

4

Including the fair value of the investment properties subject to disposal of receivables, which stands at 233,138 K EUR.

5

Note 22 reconciles the total changes in fair value of the investment properties.

176

ANNUAL ACCOUNTS /

Notes to the consolidated accounts