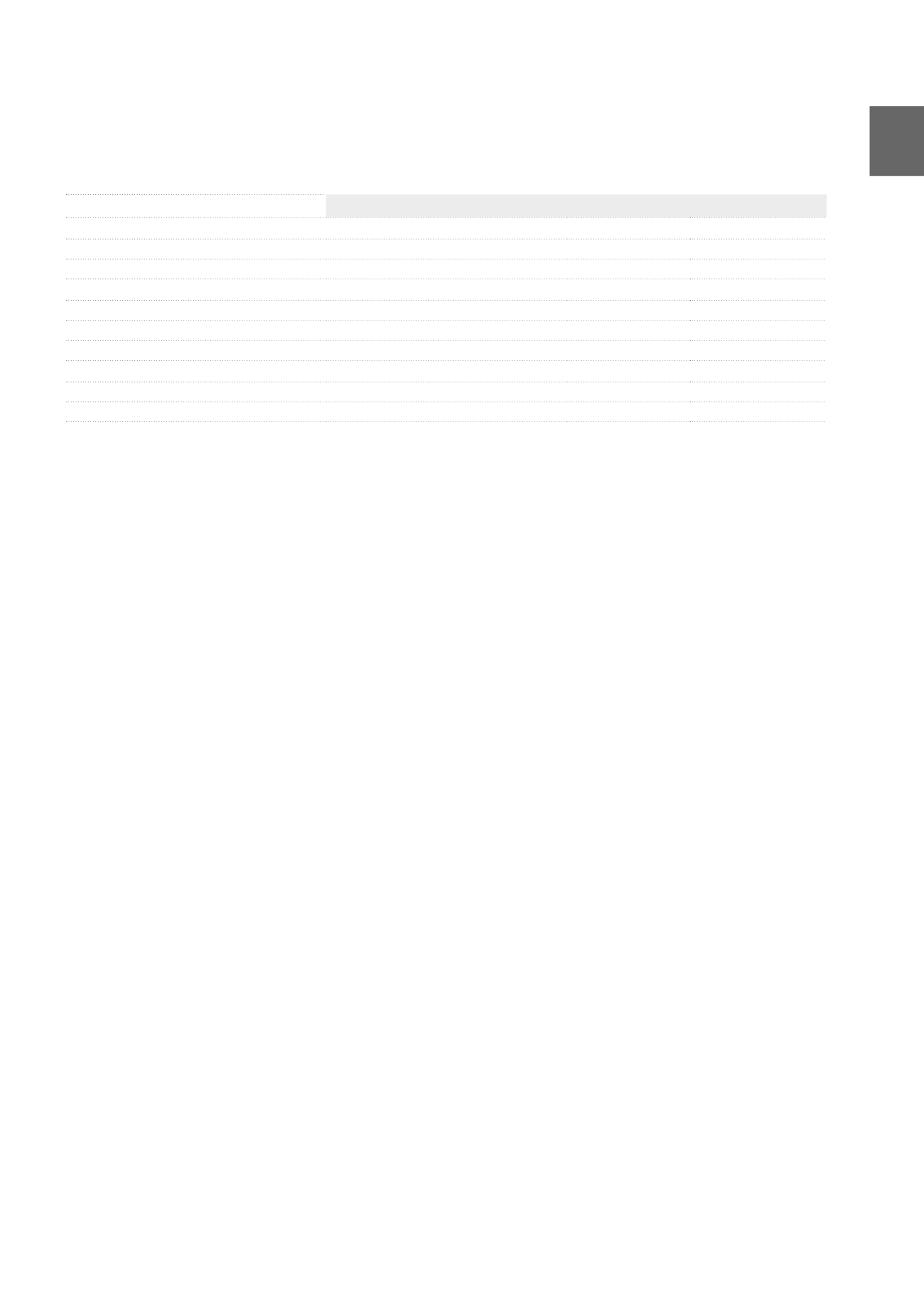

Variations du goodwill

(x 1,000 EUR)

Pubstone Belgium Pubstone Netherlands

CIS France

Total

Cost

AT 01.01.2015

100,157

39,250

26,929

166,336

AT 31.12.2015

100,157

39,250

26,929

166,336

Writedowns

AT 01.01.2015

44,380

3,600

47,980

Writedowns recorded during the financial year

4,800

2,300

7,100

AT 31.12.2015

49,180

5,900

55,080

Book value

AT 01.01.2015

55,777

35,650

26,929

118,356

AT 31.12.2015

50,977

33,350

26,929

111,256

Impairment test

At the end of the financial year 2015, the goodwill was subject to an

impairment test (executed on the groups of properties to which it was

allocated per country), by comparing the fair value of the properties

plus the goodwill to their value in use.

The fair value of the buildings is the value of the portfolio as estab-

lished by the independent real estate experts. This fair value is

established using three valuation methods: the ERV (Estimated Rental

Value) capitalisation approach, the expected cash flow approach

and the residual valuation approach. To carry out the calculation, the

independent real estate experts take as main assumptions the index-

ation rate, the discount rate and the buildings’ estimated end-of-lease

disposal value. These assumptions are based on market observations

taking into account investors’ expectations, particularly regarding

revenue growth and market risk premium. For further information, see

the Report of the Real Estate Experts of this Annual Financial Report.

The value in use is established by the Group according to expected

future net cash flows based on the rents stipulated in the tenants’

leases, the expenses to maintain and manage the property portfolio,

and the expected gains from disposals. The main assumptions are

the indexation rate, the discount rate, an attrition rate (number of

buildings and corresponding volume of revenues for which the tenant

will terminate the lease, year after year), as well as the buildings’

end-of-lease disposal value. These assumptions are based on the

Group’s knowledge of its own portfolio. The return required on its

shareholders’ equity is used as the discount rate.

Given the different methods used to calculate the fair value of the

buildings as established by the independent real estate experts and

the value in use as established by the Group, as well as the fact that

the assumptions used to calculate each of these may differ, the two

values may not be the same and the differences can be justified.

For 2015, the result of this test (illustrated in the table below) leads to

an impairment of 4,800 K EUR on the goodwill of Pubstone Belgium

and 2,300 K EUR on the goodwill of Pubstone Netherlands. For CIS,

no impairment was recorded. During the financial year 2015, the fair

value of the Pubstone Belgium and Pubstone Netherlands port-

folios recorded negative variations of respectively 400 K EUR and

2,783 K EUR, whereas the fair value of CIS recorded a positive variation

of 3,306 K EUR.

Assumptions used in the calculation of the value

in use of Pubstone

A projection of future net cash flows was drawn up for the remaining

duration of the lease bearing on the rents less the maintenance costs,

investments and operating expenses, as well as the proceeds from

asset disposals.

During this remaining period, an attrition rate is taken into account

based on the terms of the lease signed with AB InBev. The buildings

vacated are assumed to have all been sold. At the end of the initial

27-year lease, a residual value is calculated. The sale price of the

properties and the residual value are based on the average value of

the portfolio per square meter assessed by the expert at 31.12.2015

indexed to 1% (2014: 1%) per year. In 2014, a 15% margin had been

increased to the expert’s value starting from the fourth year. This

margin was based on the realised gains observed on the sale of

pubs/restaurants since the acquisition of the Pubstone portfolio. Out

of caution, in the cash flow projection, this margin was reduced to nil

in 2015.

The indexation considered on these cash flows decreases gradu-

ally from 1.70% to 1.50% starting from the second year for Pubstone

Belgium. The indexation is progressive for Pubstone Netherlands from

1.20% to 1.50% starting from the second year. In 2014, the indexation

was progressive from 0.5% to 1.50% (starting from the fifth year) for

the two portfolios Pubstone Belgium and Pubstone Netherlands.

The discount rate used amounts to 5.60% (2014: 5.80%).

Assumptions used in the calculation of the value

in use of CIS

A projection was drawn up of future net cash flows over 27 years. The

assumption adopted is the renewal of all the leases during a 27-year

period from the acquisition date.

The cash flow comprises the present indexed rent up to the date of

the first renewal of the lease. After this date, the cash flow consid-

ered is the indexed allowable rent. Cash expenditures foreseen in the

buildings’ renovation plan are also taken into account. Allowable rents

are rents estimated by the expert, stated in his portfolio valuation at

31.12.2015, which are considered sustainable in the long term in terms

of the profitability of the activity of the operating tenant.

At the 28

th

year, a residual value is calculated per property.

The indexation considered for these cash flows stands at 2% per year

(2014: 2%).

The discount rate used amounts to 5.60% (2014: 5.80%).

the positive difference between the conventional value offered for

the property assets at the acquisition (on which the price paid for the

shares was based) and the fair value of these property assets (being

expressed after deduction of the transfer duties standing at 1.8% and

6.2% in France).

175