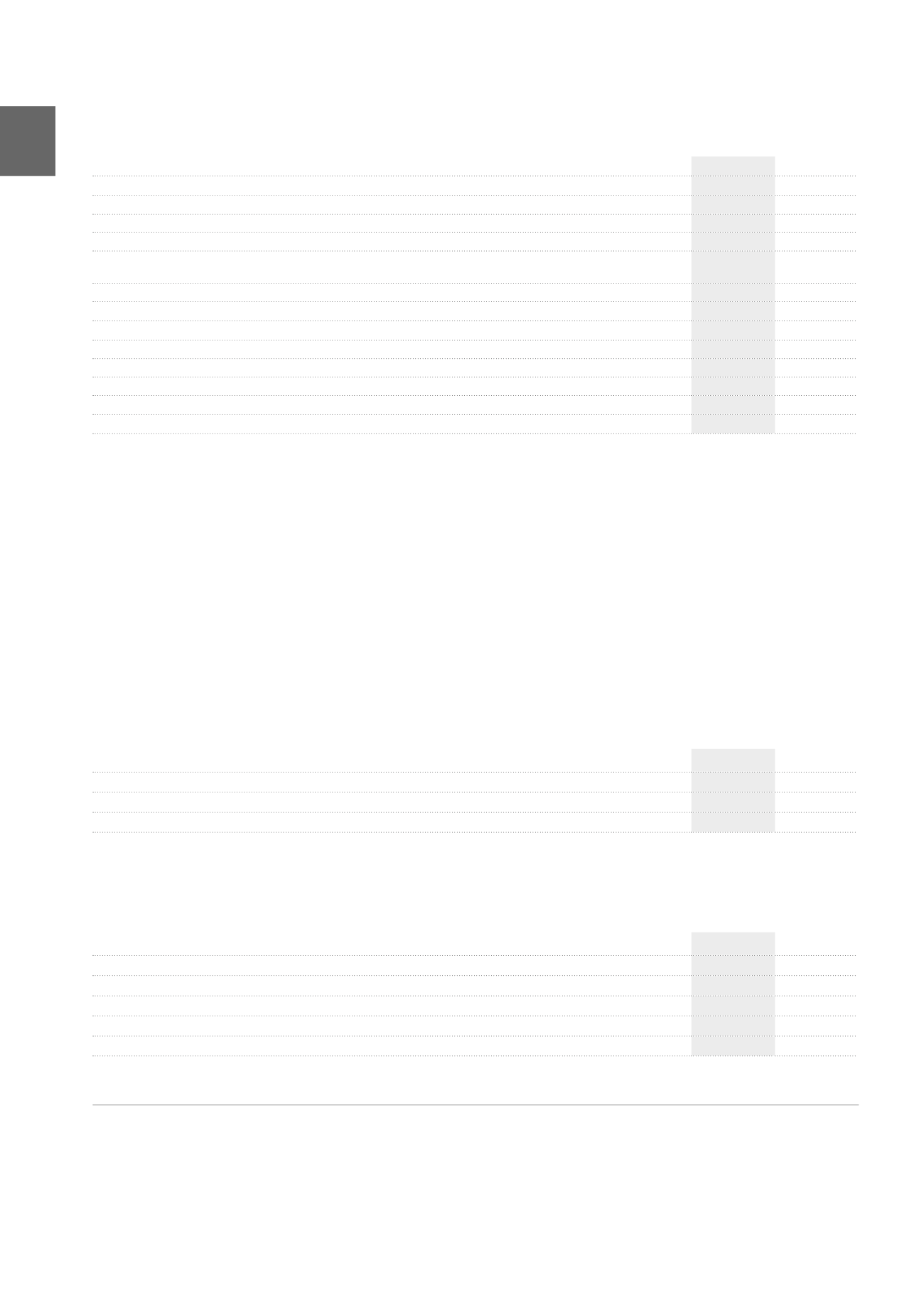

NOTE 14. OTHER RESULT ON THE PORTFOLIO

(x 1,000 EUR)

2015

2014

Changes in the deferred taxes

3

-744

-1,739

Writeback of rents already earned but not expired

-550

505

Goodwill impairment

4

-7,100

-11,000

Other

-164

930

TOTAL

-8,558

-11,304

The writeback of already earned rents not expired, recognised during the period, results from the application of the accounting method detailed in

Note 2, paragraph R.

NOTE 13. CHANGES IN FAIR VALUE OF INVESTMENT PROPERTIES

(x 1,000 EUR)

2015

2014

Positive changes in the fair value of investment properties

39,848

55,806

Negative changes in the fair value of investment properties

-48,468

-61,261

TOTAL

-8,620

-5,455

The breakdown of the changes in fair value of properties is presented in Note 22.

1

As the accounting method has been adapted on 01.01.2015, the split between investment value of assets sold and writeback of the impact on fair value of estimated transaction

costs and taxes resulting from hypothetical disposal of investment properties is no longer relevant.

2

In 2014, the amount of 10,967 K EUR corresponded to the capital loss realised during the transfer of the subsoil of the North Galaxy from Cofinimmo SA/NV to

Galaxy Properties SA/NV as well as the cancellation of the reconstitution of the lease payments sold and discounted recorded since 01.01.2014.

3

See Note 35.

4

See Note 20.

NOTE 12. RESULT ON DISPOSALS OF INVESTMENT PROPERTIES AND

OTHER NON-FINANCIAL ASSETS

(x 1,000 EUR)

2015

2014

Disposal of investment properties

(A)

Net disposal of properties (selling price - transaction costs)

26,383

75,351

(B)

Book value of properties sold (fair value of assets sold)

-24,363

-70,855

(C)

Investment value of assets sold

1

-74,014

Writeback of the impact on fair value of estimated transaction costs and rights resulting from hypothetical disposal of

investment properties

1

3,159

Other

9

612

SUBTOTAL

2,029

1,949

Disposal of other non-financial assets

Net disposals of other non-financial assets

20,396

6,530

Book value of other non-financial assets sold

-19,953

Other

-10,967

2

SUBTOTAL

20,396

-24,390

TOTAL

22,425

-22,441

Since 2015, future hypothetical transaction fees and costs are

charged directly to the income statement when properties are

acquired (and no longer to shareholders’ equity as previously – see

Note 2 for more details). When the properties are sold, this amount

therefore must not be deducted from the difference between the price

obtained and the book value of these properties in order to calculate

the gain or loss effectively made. Costs are already recognised on the

income statement at acquisition.

Given the adaptation of the treatment of transfer fees and costs,

gains or losses on disposals of investment properties are calculated

in 2015 by comparing the net sale of buildings

(A)

at their fair value

(B)

. In 2014, the gains or losses on disposals of investment properties

were calculated by comparing the net sale of properties

(A)

with their

investment value

(C)

.

The added value on the sale of other non-financial assets is

related to the sale of all the shares of Livingstone II SA/NV and

Silverstone SA/NV. The sale price of the shares of these two compa-

nies was 139.8 million EUR; the difference between this and the

agreed value of the buildings mainly consisted of debts taken over by

the buyers.

These transactions allowed Cofinimmo to realise an accounting gain

of 20,396 K EUR, which results mainly from the difference between the

price received by Cofinimmo for the shares of the two companies and

their book values.

As a reminder, the capital loss of 24,390 K EUR realised in 2014 is

related to the sale of all the shares of Galaxy Properties SA/NV, owner

of the North Galaxy building.

172

ANNUAL ACCOUNTS /

Notes to the consolidated accounts