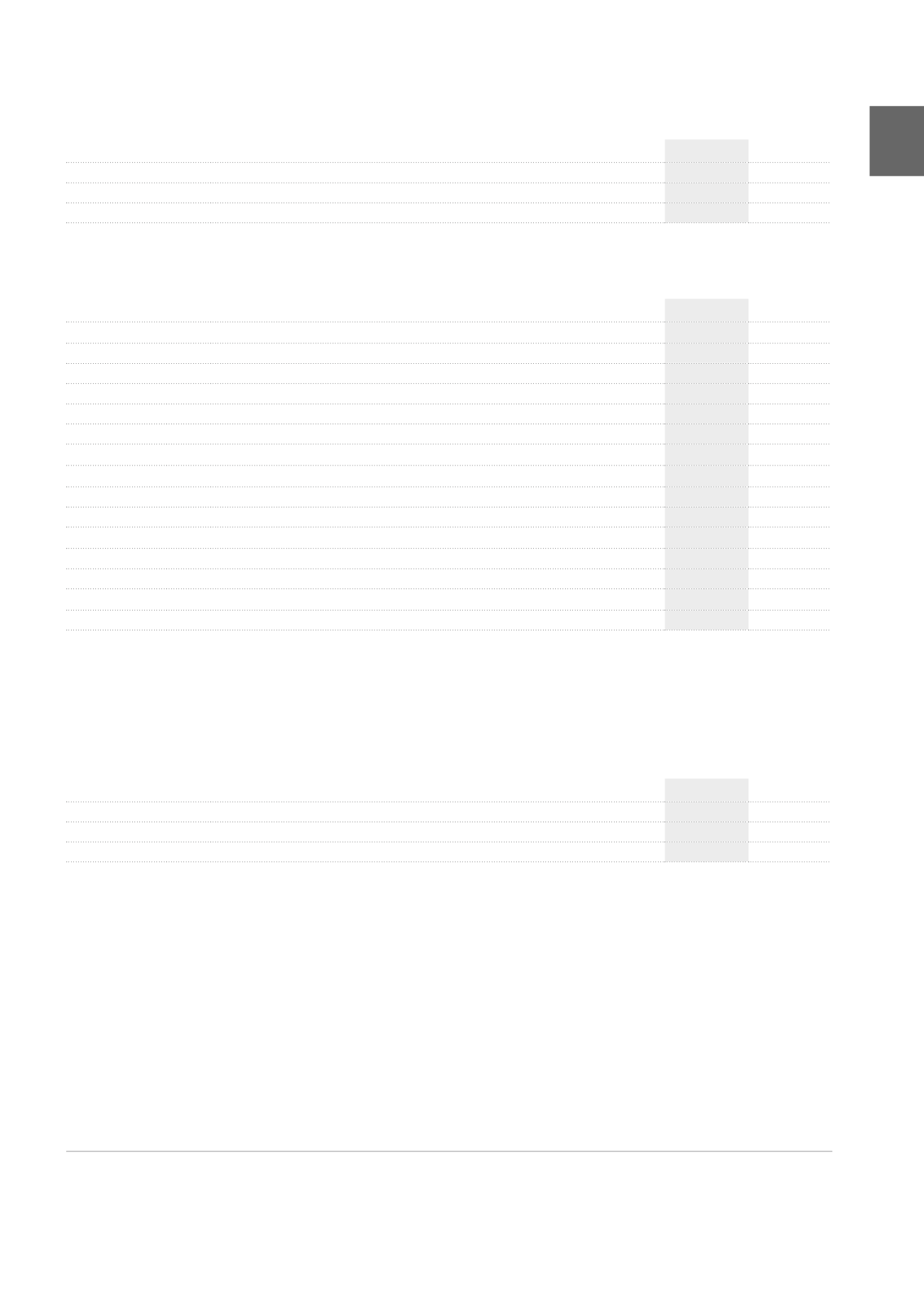

NOTE 16. NET INTEREST CHARGES

(x 1,000 EUR)

2015

2014

Nominal interest on borrowings

24,698

32,194

Bilateral loans - floating rate

4,479

7,623

Commercial papers - floating rate

1,150

926

Investment credits - floating or fixed rate

606

634

Bonds - fixed rate

9,230

13,778

Convertible bonds

9,233

9,233

Reconstitution of the nominal value of financial debts

1,167

721

Charges relating to authorised hedging instruments

17,066

31,738

Authorised hedging instruments qualifying for hedge accounting under IFRS

6,043

21,644

Authorised hedging instruments not qualifying for hedge accounting under IFRS

11,023

10,094

Income relating to authorised hedging instruments

-3,758

-13,283

Authorised hedging instruments qualifying for hedge accounting under IFRS

-54

-9,203

Authorised hedging instruments not qualifying for hedge accounting under IFRS

-3,704

-4,080

Other interest charges

2

3,137

3,304

TOTAL

42,310

54,700

NOTE 15. FINANCIAL INCOME

(x 1,000 EUR)

2015

2014

Interests and dividends received

1

1,149

1,537

Interest receipts from finance leases and similar receivables

4,586

4,040

TOTAL

5,735

5,577

1

The amount of dividends received is nil at 31.12.2015.

2

These are commissions on unused credit.

3

In 2015, the interest on borrowings at amortised cost (2015: 19,769 K EUR/2014: 27,012 K EUR) consisted of “Other interest charges”, the “Reconstitution of the nominal value of

financial debts” as well as “Nominal interest on borrowings” (with the exception of the “Convertible bonds”). Interest on borrowings at fair value through net result (2015: 22,541 K

EUR/2014: 27,688 K EUR) consists of “Charges and income resulting from authorised hedging instruments allowed” as well as “Convertible bonds”.

NOTE 17. OTHER FINANCIAL CHARGES

(x 1,000 EUR)

2015

2014

Bank fees and other commissions

340

320

Other

320

1,989

TOTAL

660

2,309

The effective interest charges on loans correspond to an average

effective interest rate on loans of 2.90% (2014: 3.43%). The effective

charge without taking into account the hedging instruments stands

at 1.99%. This percentage can be split up between 2.54% for the

borrowings at fair value and 1.81% for the borrowings measured at

amortised cost

3

.

173