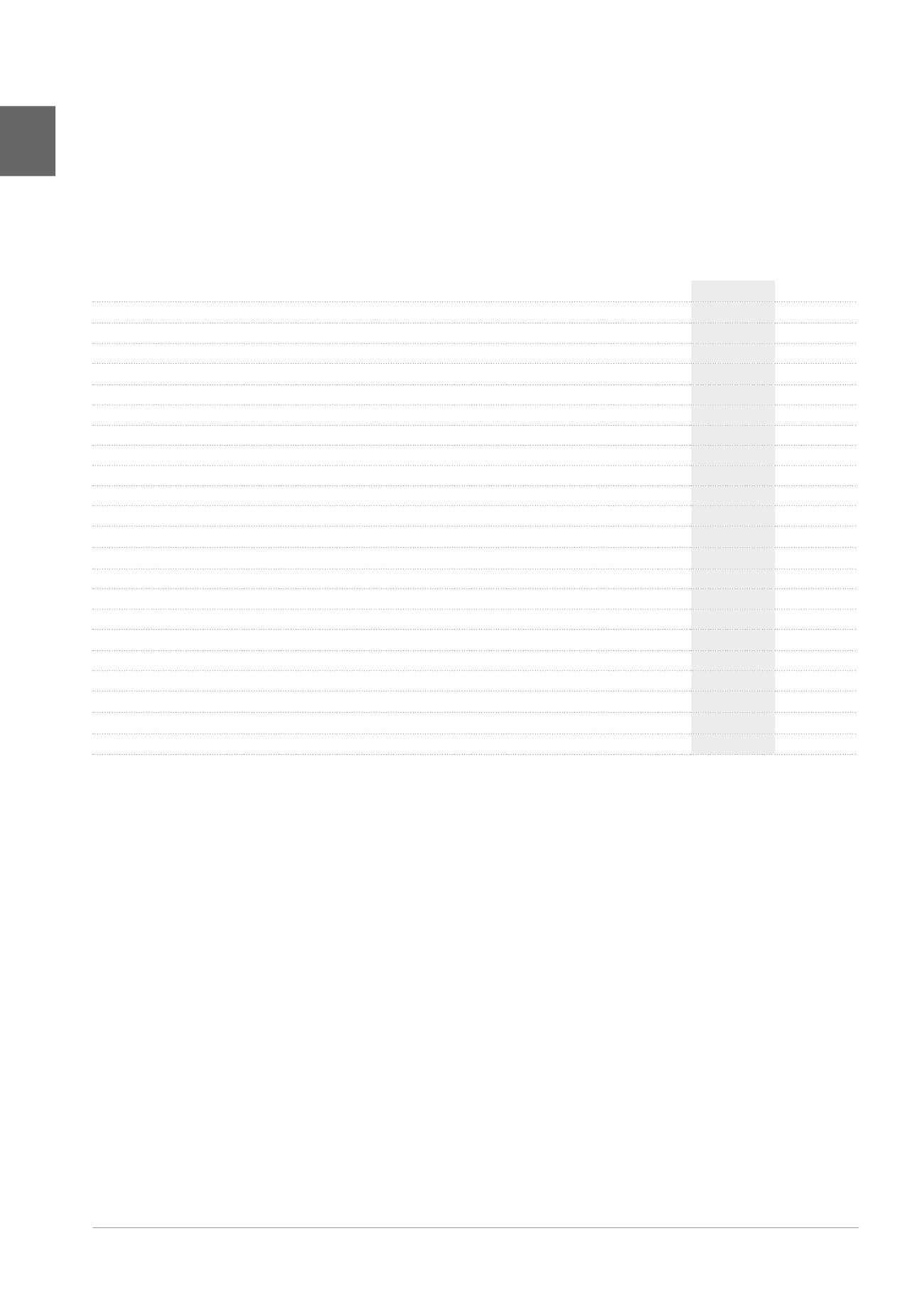

(x 1,000 EUR)

2015

2014

Office charges

1,828

1,606

IT

811

789

Other

1,017

817

Fees paid to third parties

4,853

3,195

Recurrent

3,067

2,650

Real estate experts

1,063

988

Lawyers

125

62

Property management

461

327

Other

1,418

1,273

Non-recurrent

1,786

545

Mergers and acquisitions (other than business combinations)

1,786

545

Public relations, communication and advertising

529

572

Personnel expenses

11,128

10,916

Salaries

8,433

8,228

Social security

1,651

1,633

Pensions and other benefits

1,044

1,055

Fees earned

-3,609

-2,555

Management fees related to the lease contracts

1

-3,369

-2,284

Fees for additional services

-240

-271

Taxes and regulatory fees

533

427

Depreciation charges on office furniture

81

134

TOTAL

15,343

14,295

NOTE 11. MANAGEMENT COSTS

Management costs are split between asset management costs and other costs.

Property management costs

These costs comprise the costs of the personnel responsible for this activity, the operational costs of the company headquarters and the fees

paid to third parties. The management fees collected from tenants partially covering the costs of the Property Management activity are deducted.

The portfolio is managed in-house, except for the MAAF insurance agencies portfolio and the health real estate properties in Germany. The internal

costs of property management are divided as follows:

1

Management fees related to the lease contracts include rebillings of the management costs of the buildings to the tenants.

The fees of the real estate experts amounted to 1,190,690 EUR for 2015, this figure including both recurrent and non-recurrent fees. These emolu-

ments are calculated partially based on a fixed amount per square metre and partially based on a fixed amount per property.

Corporate management costs

The corporate management costs cover the overhead costs of the company as a legal entity listed on the stock exchange and as an RREC. These

expenses are incurred in order to provide complete and continued information, economic comparability with other types of investment and

liquidity for the shareholders who invest indirectly in a property portfolio. Certain costs of studies relating to the Group’s expansion also come

under this category.

170

ANNUAL ACCOUNTS /

Notes to the consolidated accounts