NOTE 20. GOODWILL

Pubstone

Cofinimmo’s acquisition in two stages (31.10.2007 and 27.11.2008) of

89.90% of the shares of Pubstone Group SA/NV (formerly Express

Properties SA/NV) (see page 31 of the 2008 Annual Financial Report)

generated a goodwill for Cofinimmo resulting from the positive differ-

ence between the acquisition cost and Cofinimmo’s share in the fair

value of the net asset acquired. More specifically, this goodwill results

from:

•

the positive difference between the conventional value offered for

the property assets at the acquisition (on which the price paid for

the shares was based) and the fair value of these property assets

(being expressed after deduction of the transfer duties standing at

10.0% or 12.5% in Belgium and at 6.0% in the Netherlands);

•

the deferred tax corresponding to the theoretical assumption

required under IAS/IFRS of an immediate disposal of all the

properties at the closing date. A tax rate of respectively 34% and

25% for the assets located in Belgium and in the Netherlands has

been applied to the difference between the tax value and the

market value of the assets at the acquisition.

Cofinimmo Investissements et Services (CIS)

Cofinimmo’s acquisition of 100% of the shares of Cofinimmo

Investissements et Services (CIS) SA (formerly Cofinimmo France SA)

on 20.03.2008 generated a goodwill for Cofinimmo resulting from the

positive difference between the acquisition cost and the fair value of

the net asset acquired. More specifically, this goodwill results from

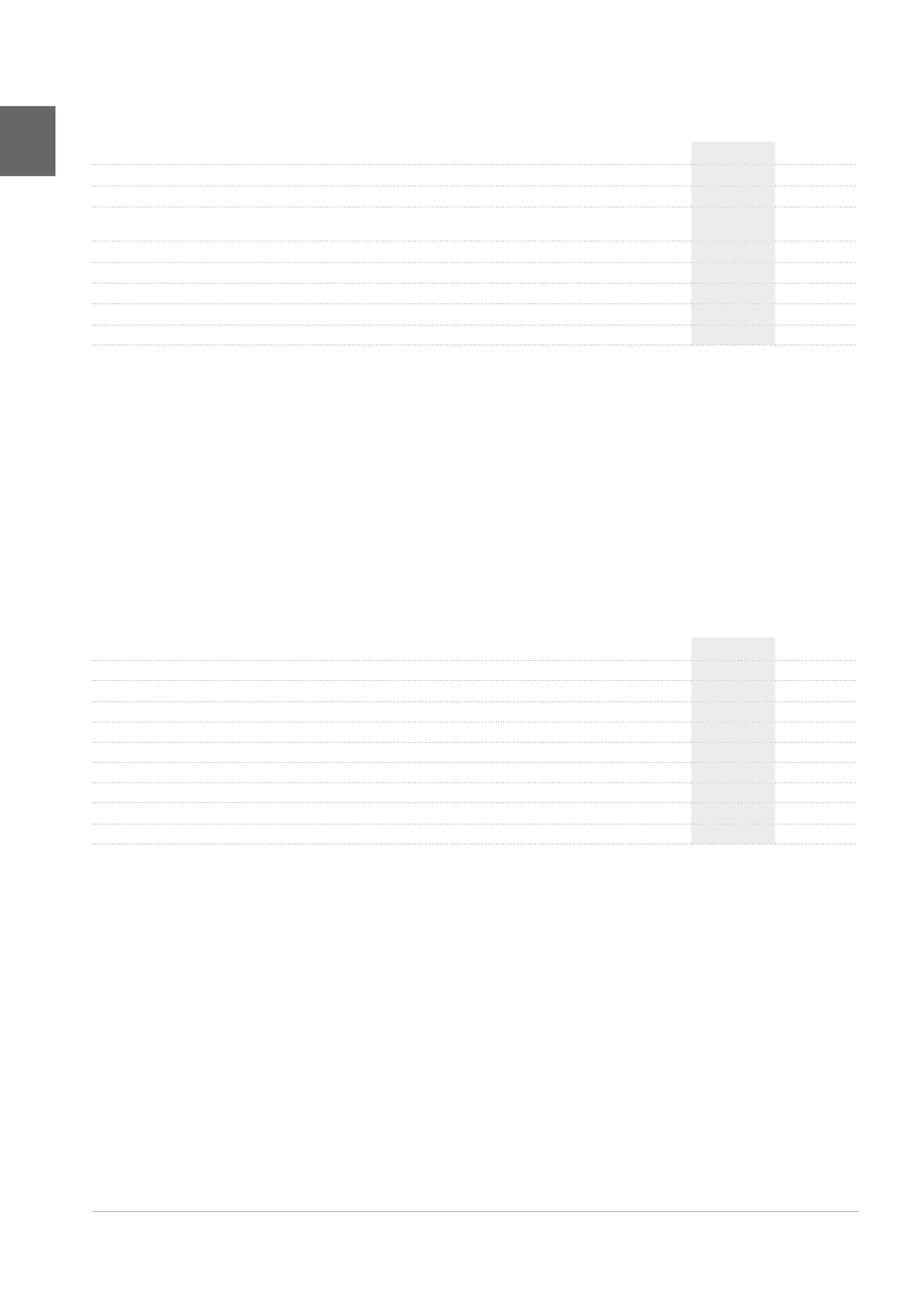

NOTE 19. CORPORATE TAX AND EXIT TAX

(x 1,000 EUR)

2015

2014

CORPORATE TAX

4,209

2,493

Parent company

1,888

1,425

Pre-tax result

107,597

-52,775

Result exempted from income tax due to the RREC regime

-107,597

52,775

Taxable result from non-deductible costs

4,853

3,813

Tax at rate of 33.99%

1,650

1,296

Other

238

129

Subsidiaries

2,321

1,068

EXIT TAX - SUBSIDIARIES

-248

-926

The non-deductible costs mainly comprise the office tax in the Brussels Capital Region. With the exception of the institutional RRECs, the Belgian

subsidiaries are not subject to the RREC regime. The Dutch subsidiary Pubstone Properties BV is not eligible for the FBI regime.

Only the changes in the ineffective part of the fair value of cash

flow hedging instruments, as well as the changes in the fair value of

trading instruments, are taken into account here. The changes in the

effective part of the fair value of cash flow hedging instruments are

booked directly in other global result.

When a relationship between a cash flow hedging instrument and

the hedged risk is terminated (even partially), the cumulated gain or

loss at that date, until then deferred under equity, is recycled on the

income statement.

In 2014, the change in the fair value of authorised hedging instru-

ments not eligible for hedge accounting resulted from the effect of the

decrease in interest rates on their revaluation.

The impact of income statement recycling of hedging instruments

for which the relationship to the hedged risk ended results from the

restructuring of 400 million EUR in FLOOR options cancelled in 2015.

These options extended until the end of 2017. This transaction will

result in a decrease of interest charges in the coming years. The total

cost of the restructuring is 32 million EUR. For more details on the

hedging policy, see the “Management of Financial Resources” and

“Risk Factors” chapters of this Annual Financial Report.

NOTE 18. CHANGES IN THE FAIR VALUE OF FINANCIAL ASSETS AND LIABILITIES

(x 1,000 EUR)

2015

2014

Authorised hedging instruments qualifying for hedge accounting

-28,654

-54,796

Changes in fair value of authorised hedging instruments qualifying for hedge accounting

-342

1

1,719

1

Impact of the recycling on the income statement of hedging instruments which relationship with the hedged risk was

terminated

-28,312

-56,515

Authorised hedging instruments not qualifying for hedge accounting

-1,511

-79,927

Changes in fair value of authorised hedging instruments not qualifying for hedge accounting

4,648

2

-71,670

2

Convertible bonds

-6,159

-8,257

Other

-238

-1,420

TOTAL

-30,403

-136,143

1

The gross amounts are respectively an income of 167 K EUR (2014: 3,715 K EUR) and a charge of 509 K EUR (2014: 1,996 K EUR).

2

The gross amounts are respectively an income of 26,740 K EUR (2014: 3,130 K EUR) and a charge of 22,092 K EUR (2014: 74,800 K EUR).

174

ANNUAL ACCOUNTS /

Notes to the consolidated accounts