Fair value of investment properties

Investment properties are accounted for at fair value using the fair

value model in accordance with IAS 40. This fair value is the price at

which a property could be exchanged between knowledgeable and

willing parties in normal competitive conditions. It is determined by the

independent experts in a two-step approach.

In the first step, the experts determine the investment value of each

property (see methods below).

In a second step, the experts deduct from the investment value an esti-

mated amount for the transaction costs that the buyer or seller must

pay in order to carry out a transfer of ownership. The investment value

less the estimated transaction costs (transfer duties) is the fair value

within the meaning of IAS 40.

In Belgium, the transfer of ownership of a property is subject to the

payment of transfer duties. The amount of these taxes depends on the

method of transfer, the type of purchaser and the location of the prop-

erty. The first two elements, and therefore the total amount of taxes to

be paid, are only known once the transfer has been completed.

The range of taxes for the major types of property transfer includes:

•

sale contracts for property assets: 12.5% for properties located

in the Brussels Capital Region and in the Walloon Region, 10% for

properties located in the Flemish Region;

•

sale of property assets under the rules governing estate traders:

4.0% to 8.0%, depending on the Region;

•

long lease agreement for property assets (up to 50 years for

building leases and up to 99 years for long lease rights): 2.0%;

•

sale contracts for property assets where the purchaser is a public

body (e.g. an entity of the European Union, the Federal Government,

a regional government or a foreign government): tax exemption;

•

contribution in kind of property assets against the issue of new

shares in favour of the contributing party: tax exemption;

•

sale contract for shares of a real estate company: no taxes;

•

merger, split and other forms of company restructuring: no taxes,

etc.

The effective rate of the transfer tax therefore varies from 0% to 12.5%,

whereby it is not possible to predict which rate would apply to the

transfer of a given property before that transfer has effectively taken

place.

In January 2006, all the independent real estate experts

2

who carry

out the periodic valuation of the Belgian Sicafis’/Bevaks’ assets were

asked to compute a weighted average transaction cost percentage to

apply on the Sicafis’/Bevaks’ property portfolios, based on supporting

historical data.

For transactions concerning properties with an overall value exceeding

2.5 million EUR, given the range of different methods for property trans-

fers (see above), the experts have calculated, on the basis of a repre-

sentative sample of 220 transactions which took place in the market

between 2003 and 2005 and totalling 6.0 billion EUR, that the weighted

average transfer tax comes to 2.5%. This percentage is reviewed annu-

ally and, if necessary, adjusted at each 0.5% threshold.

For transactions concerning properties with an overall value of less

than 2.5 million EUR, transaction costs of between 10.0% and 12.5%

apply, depending on the Region in which the property is located.

At 01.01.2004 (date of transition to IAS/IFRS), the transaction costs

deducted from the investment value of the property portfolio amounted

to 45.5 million EUR and were recorded under a separate equity item

entitled “Impact on the fair value of estimated transaction costs and

transfer duties resulting from the hypothetical disposal of investment

properties”.

The 2.5% transaction costs have been applied to the subsequent

acquisitions of buildings. At 31.12.2015, the difference between the

investment value and the fair value of the global portfolio amounted to

127.99 million EUR or 6.10 EUR per share.

It is worth noting that the average gain in relation to the investment

value realised on the disposals of assets operated since the change-

over to the Sicafi/Bevak regime in 1996 stands at 9.26%. Since that

date, Cofinimmo has undertaken 165 asset disposals for a total of

1,542.32 million EUR. This gain would have been 11.25% if the deduction

of transaction costs and transfer duties had been recognised as from

1996.

The transfer duties applied to the buildings located in France, the

Netherlands and Germany amount to 6.77%, 3.87% and 4.80%

respectively.

1

Note 22 reconciles the total changes in fair value of the investment properties.

2

Cushman & Wakefield, de Crombrugghe & Partners, Winssinger & Associés, Stadim and Troostwijk-Roux.

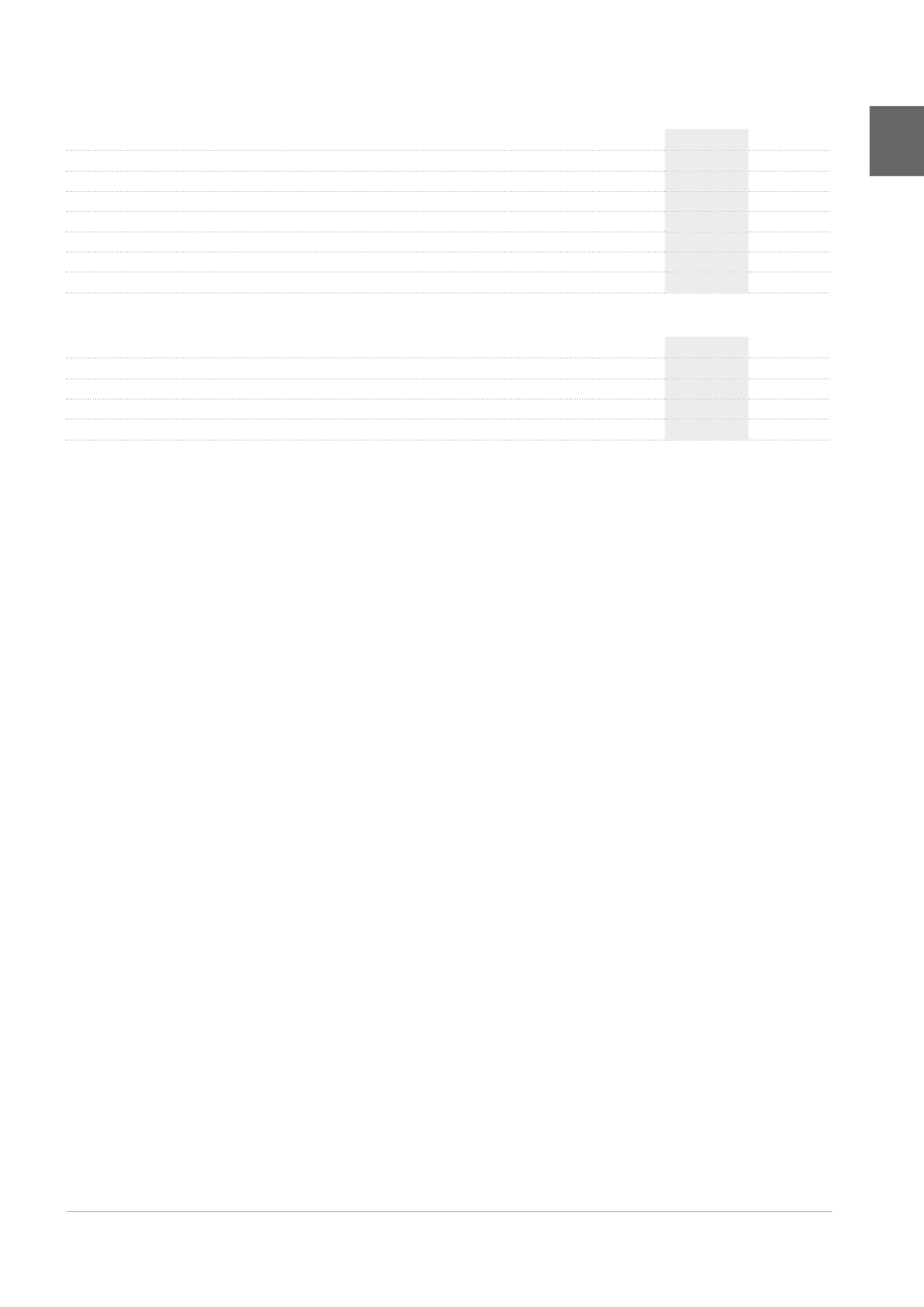

Development projects

(x 1,000 EUR)

2015

2014

AT 01.01

88,966

130,533

Investments

34,932

47,858

Acquisitions

6,158

4,705

Transfer from/to Properties available for lease

-49,381

-73,648

Sales/Disposals (fair value of assets sold/disposed of)

-19,287

-15,646

Increase/Decrease in the fair value

1

156

-4,836

AT 31.12

61,544

88,966

Assets held for own use

(x 1,000 EUR)

2015

2014

AT 01.01

8,875

9,146

Investments

51

14

Increase/Decrease in the fair value

1

-301

-285

AT 31.12

8,625

8,875

177