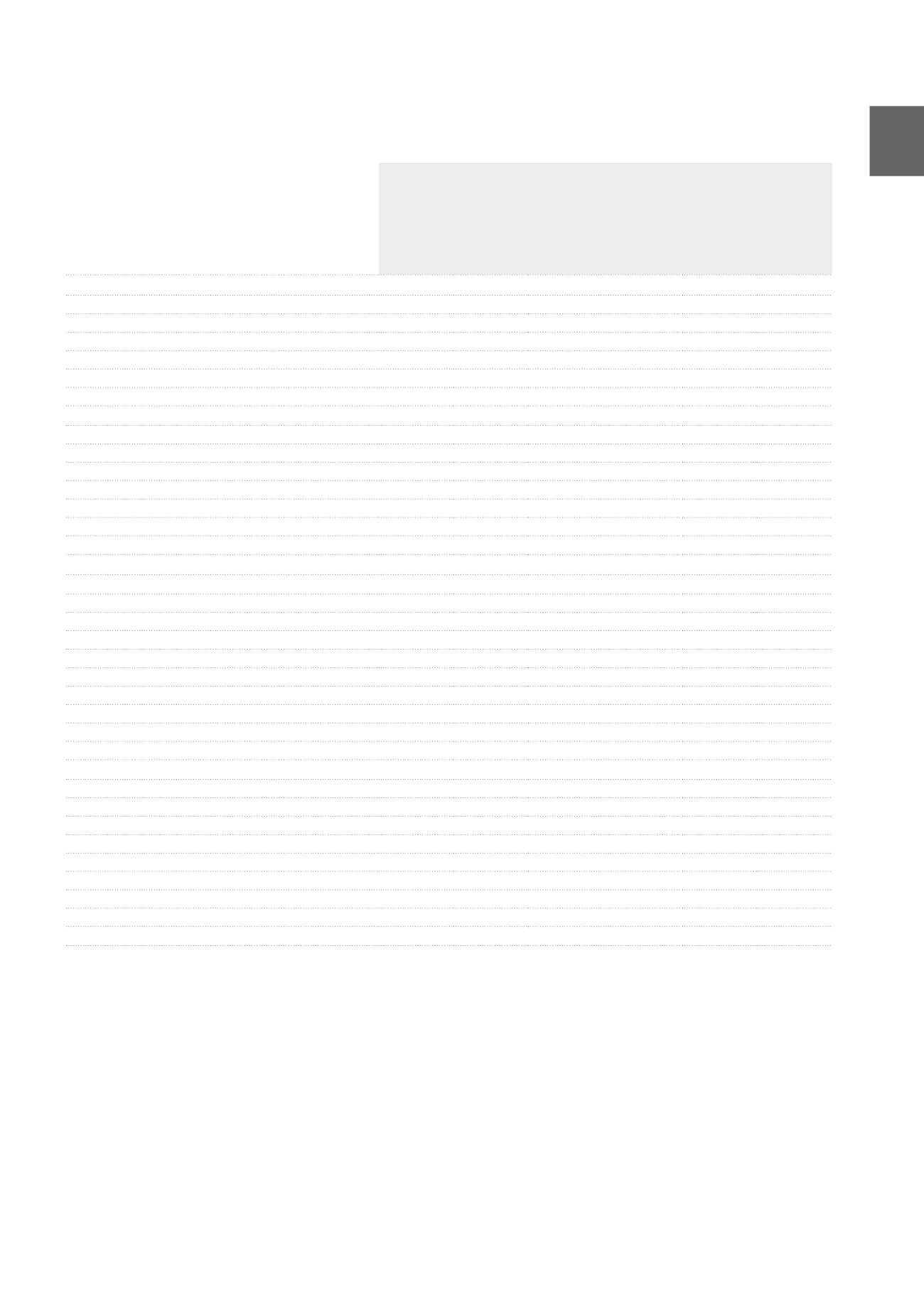

NOTE 24. FINANCIAL INSTRUMENTS

A. CATEGORIES AND DESIGNATION OF FINANCIAL INSTRUMENTS

(x 1,000 EUR)

31.12.2015

Designated

in a hedging

relationship

Designated

at fair value

through the

net result

Held for

trading

Loans,

receivables

and financial

liabilities at

amortised

cost

Fair value Fair value

qualifica-

tion

Non-current financial assets

20

81,726 130,704

Hedging instruments

20

IRS

20

20

Level 2

Credits and receivables

81,726

130,684

Non-current finance lease receivables

75,652

124,610

Level 2

Trade receivables and other non-current assets

41

41

Level 2

Participations in associated companies and joint ventures

6,033

6,033

Level 2

Current financial assets

14

43,497

44,582

Hedging instruments

14

IRS

14

14

Level 2

Credits and receivables

21,457

22,528

Current finance lease receivables

1,656

2,727

Level 2

Trade receivables

19,801

19,801

Level 2

Cash and cash equivalents

22,040

22,040

Level 2

TOTAL

34

125,223 175,286

Non-current financial liabilities

216,625 64,559

628,118 909,302

Non-current financial debts

216,625

628,118

844,743

Bonds

380,000

380,000

Level 1

(Mandatory) Convertible bonds

216,625

216,625

Level 1

Bank debts

180,229

180,229

Level 2

Commercial papers - fixed rate

26,000

26,000

Level 2

Rental guarantees received

6,603

6,602

Level 2

Deferred taxes

35,286

35,286

Level 2

Other non-current financial liabilities

64,559

64,559

IRS

64,559

64,559

Level 2

Current financial liabilities

20,572

508,541

529,113

Current financial debts

445,676

445,676

Level 2

Commercial papers - floating rate

220,500

220,500

Level 2

Convertible bonds

174,771

174,771

Level 1

Bank debts

50,352

50,352

Level 2

Other

53

53

Level 2

Other current financial liabilities

20,572

20,572

IRS

20,572

20,572

Level 2

Trade debts and other current debts

62,865

62,865

Level 2

TOTAL

216,625

85,131

1,136,659 1,438,415

183