1

The basis for the valuations resulting in the fair values can be classified according to IFRS 13 as:

- level 1: quoted prices observable in active markets;

- level 2: observable data other than the quoted prices included in level 1;

- level 3: unobservable data.

Valuation methods used

Based on a multi-criteria approach, the valuation methods used by

the real estate experts are the following:

Discounted estimated rental value method

This method involves capitalising the property’s estimated rental

value by using a capitalisation rate (yield) in line with the real estate

market. The choice of the capitalisation rate used depends essen-

tially on the capitalisation rates applied in the property investment

market, taking into consideration the location and the quality of the

property and of the tenant at the valuation date. The rate corresponds

to the rate anticipated by potential investors at the valuation date.

The determination of the estimated rental value takes into account

market data, the property’s location, its quality, the number of beds

for healthcare assets and, if available, the tenant’s financial data

(EBITDAR).

The resulting value must be adjusted if the current rent generates an

operating income above or below the estimated rental value used for

the capitalisation. The valuation also takes into account the costs to

be incurred in the near future.

Discounted cash flow method

This method requires an assessment of the net rental income

generated by the property on an annual basis during a defined period.

This flow is then discounted. The projection period generally varies

between 10 and 18 years. At the end of this period, a residual value is

calculated using the capitalisation rate on the terminal value, which

takes into account the building’s expected condition at the end of the

projection period, discounted.

Market comparables method

This method is based on the principle that a potential buyer will not

pay more for the acquisition of a property than the price recently paid

on the market for the acquisition of a similar property.

Residual value method

The value of a project is determined by defining what can/will be

developed on the site. This means that the purpose of the project

is known or foreseeable in terms of quality (planning) and quantity

(number of square meters that can be developed, future rents, etc.).

The value is obtained by deducting the costs to completion of the

project from its anticipated value.

Other considerations

If the fair value cannot be determined reliably, the properties are

valued at the historical cost. In 2015, the fair value of all properties

could be determined reliably so that no building was valued at

historical cost.

In the event that the future selling price of a property is known at the

valuation date, the properties are valued at the selling price.

For the buildings for which several valuation methods were used, the

fair value is the average of the results of these methods.

During the year 2015, there was no transfer between level 1, level 2,

and level 3 (within the meaning of IFRS 13). In addition, there was no

change in valuation methods for the investment properties in 2015.

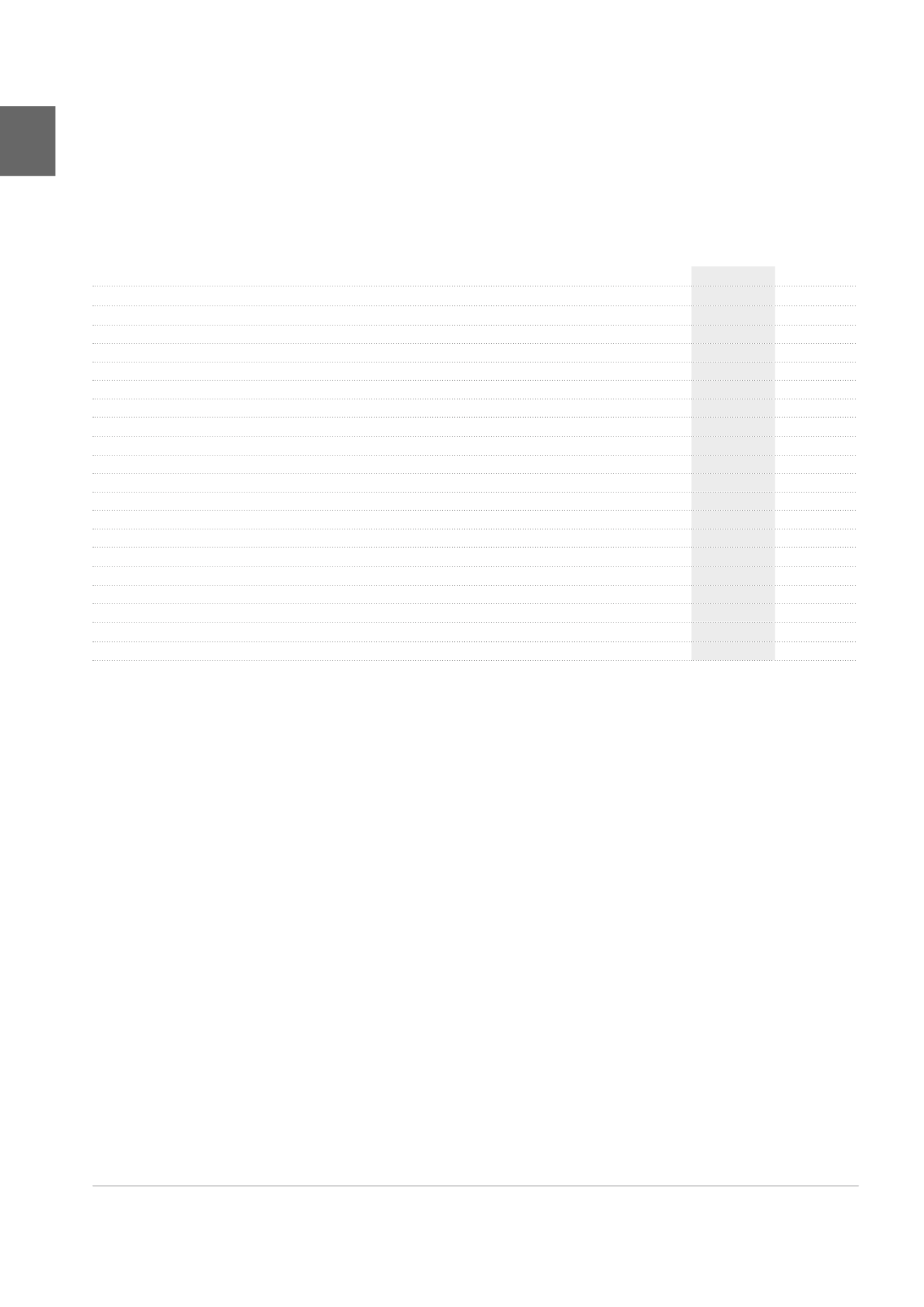

(x 1,000 EUR)

31.12.2015

31.12.2014

Asset category

1

Level 3

Level 3

Healthcare real estate

1,328,287

1,289,103

Belgium

770,420

804,956

France

378,824

375,417

Netherlands

99,242

87,290

Germany

67,081

Healthcare real estate under development

12,720

21,440

Offices

1,241,149 1,311,976

Antwerp

65,635

64,945

Brussels CBD

364,245

378,917

Decentralised Brussels

511,657

547,432

Brussels Periphery/ Satellites

138,827

141,703

Other regions

115,261

113,278

Offices under development

45,524

65,701

Property of distribution networks

538,124 533,538

Pubstone Belgium

274,299

272,202

Pubstone Netherlands

147,117

149,396

Cofinimur I France

116,708

111,940

Other

26,793

64,566

TOTAL

3,134,353 3,199,183

Determination of the valuation level of the fair value of

the investment properties

The fair value of the investment properties on the balance sheet results

exclusively from the portfolio’s valuation by independent real estate

experts.

To determine the fair value of the investment properties, the nature,

characteristics and risks of these properties, as well as available

market data, were examined.

Because of the state of market liquidity and the difficulty to find

unquestionably comparable transaction data, the level of valuation,

within the meaning of IFRS 13, of the fair value of the Cofinimmo build-

ings is 3, and this for the entire portfolio.

178

ANNUAL ACCOUNTS /

Notes to the consolidated accounts