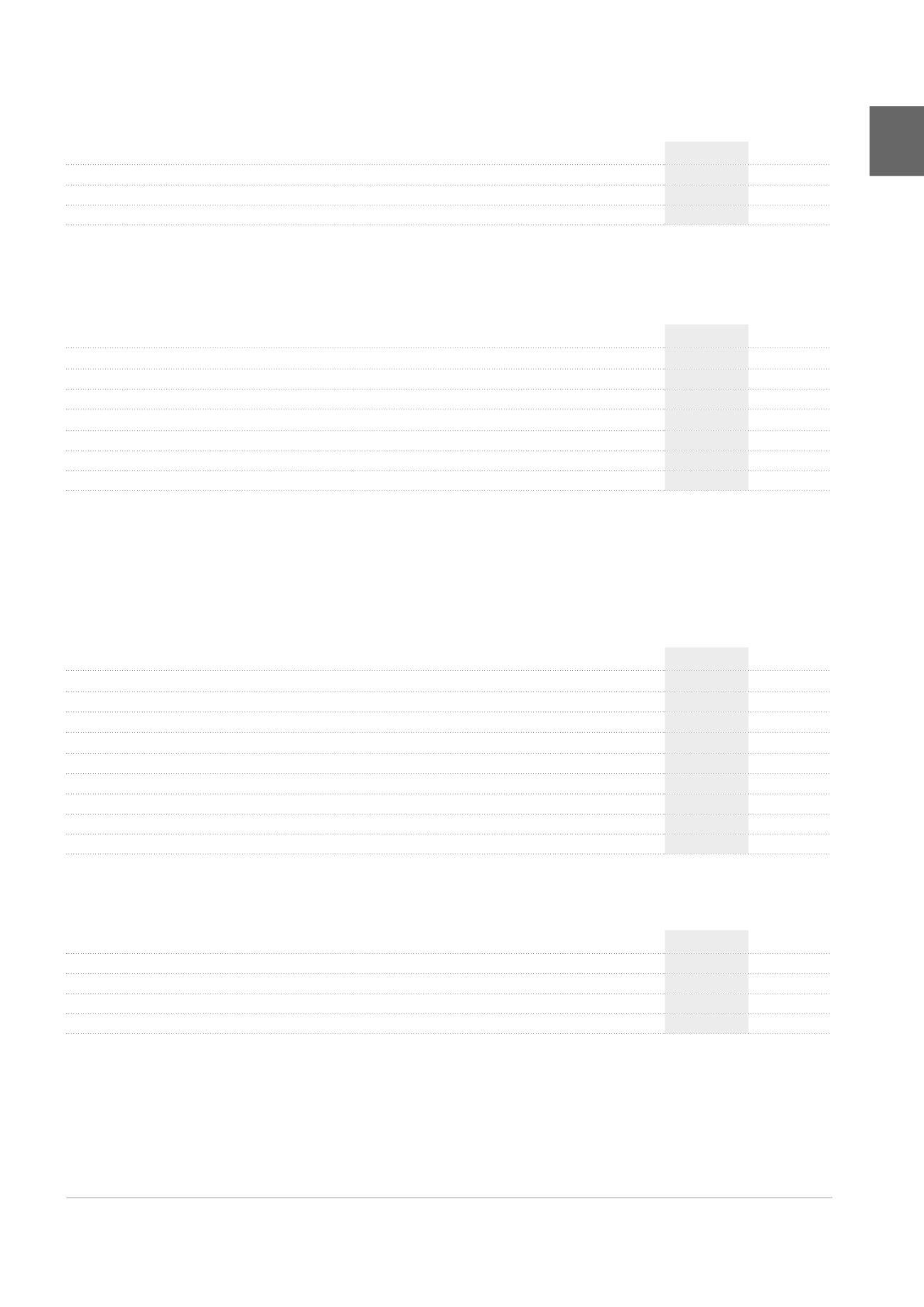

NOTE 7. NET REDECORATION EXPENSES

1

(x 1,000 EUR)

2015

2014

Costs payable by the tenant and borne by the landlord on rental damage and redecoration at end of lease

1,434

1,540

Recovery of property charges

-329

-612

TOTAL

1,105

928

The recovery of property charges exclusively comprises indemnities on rental damage.

NOTE 9. TECHNICAL COSTS

(x 1,000 EUR)

2015

2014

Recurrent technical costs

5,316

3,601

Repairs

5,058

3,208

Insurance premiums

258

393

Non-recurrent technical costs

327

201

Major repairs (building companies, architects, engineering offices, etc.)

2

302

268

Damage expenses

25

-67

Losses providing from disasters and subject to insurance cover

450

213

Insurance compensation for losses providing from disasters

-425

-280

TOTAL

5,643

3,802

NOTE 8. TAXES AND CHARGES ON RENTED PROPERTIES NOT RECOVERED FROM TENANTS

(x 1,000 EUR)

2015

2014

Recovery income of charges and taxes normally payable by the tenant on let properties

41,588

44,756

Rebilling of rental charges invoiced to the landlord

16,916

16,971

Rebilling of withholding taxes and other taxes on let properties

24,672

27,785

Charges and taxes normally payable by the tenant on let properties

-45,066

-47,512

Rental charges invoiced to the landlord

-17,570

-17,334

Withholding taxes and other taxes on let properties

-27,496

-30,178

TOTAL

-3,478

-2,756

NOTE 10. COMMERCIAL COSTS

(x 1,000 EUR)

2015

2014

Letting fees paid to real estate brokers

634

740

Advertising

118

85

Fees paid to experts

198

312

TOTAL

950

1,137

1

According to Annex C of the Royal Decree of 13.07.2014, the exact terminology is “Costs payable by the tenant and borne by the landlord on rental damage and redecoration at

end of lease” and “Recovery of property charges”.

2

Except for capital expenditures.

Under usual lease terms, these charges and taxes are borne by the

tenants through rebilling. However, a number of lease contracts of the

Group provide otherwise, leaving taxes or charges to be borne by the

landlord.

The charges and taxes not recovered at 31.12.2015 mainly include the

taxes of 1.4 million EUR not recovered on the vacant Woluwe 106-108

and Belliard 40 buildings under construction.

169