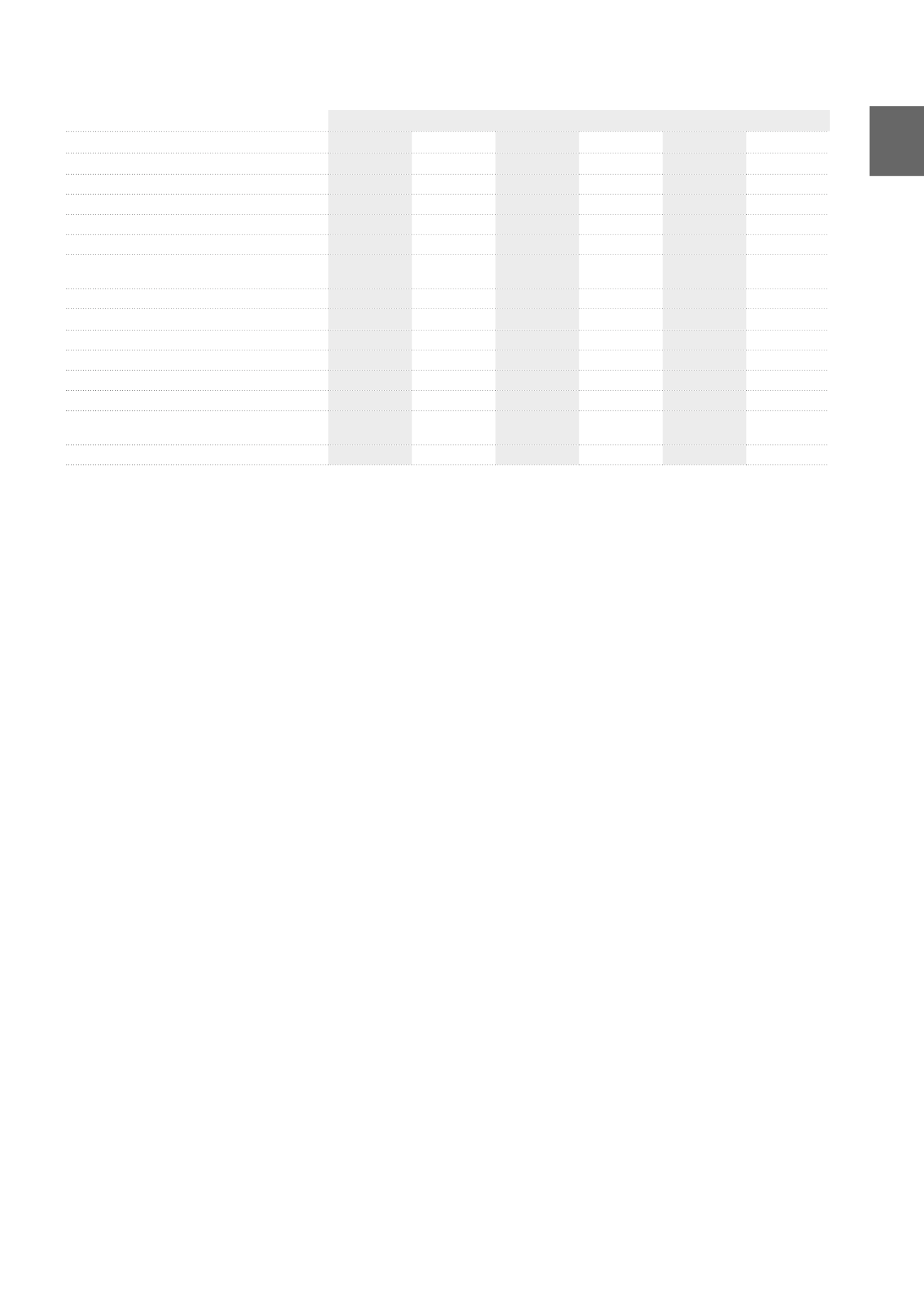

(x 1,000 EUR)

Ordinary shares

Convertible preference shares

Total

2015

2014

2015

2014

2015

2014

Capital

AT 01.01

926,458

906,099

36,609

36,726

963,067

942,825

Own shares (sold/purchased) - net

230

-294

230

-294

Issued as a result of the optional dividend

20,536

20,536

Capital increase

160,997

160,997

Conversion of preference shares into ordinary

shares

34

117

-34

-117

AT 31.12

1,087,720

926,458

36,575

36,609 1,124,295

963,067

Share premium account

AT 01.01

347,818

335,799

36,195

36,311

384,013

372,110

Own shares (sold/purchased) - net

168

-326

168

-326

Issued as a result of the optional dividend

12,229

12,229

Capital increase

120,059

120,059

Conversion of preference shares into ordinary

shares

34

116

-34

-116

AT 31.12

468,079

347,818

36,161

36,195

504,240

384,013

Categories of shares

The Group issued two categories of shares:

Ordinary shares:

the holders of ordinary shares are entitled to receive

dividends when these are declared and are entitled to one vote per

share at the General Shareholders’ Meetings of the company. The par

value of each ordinary share is 53.59 EUR on 31.12.2015. The ordinary

shares are listed on the First Market of Euronext Brussels.

Convertible preference shares:

the preference shares were issued

in 2004 in two distinct series which both feature the following main

characteristics:

•

priority right to an annual fixed gross dividend of 6.37 EUR per

share, capped at this level and non-cumulative;

•

priority right in case of liquidation to a distribution equal to the

issue price of these shares, capped at this level;

•

option for the holder to convert his preference shares into ordinary

shares from the fifth anniversary of their issue date (01.05.2009), at

a rate of one ordinary share for one preference share;

•

option for a third party designated by Cofinimmo (for example, one

of its subsidiaries) to purchase in cash and at their issue price the

preference shares that have not yet been converted, from the 15

th

anniversary of their issue date (2019);

•

the preference shares are registered, listed on the First Market of

Euronext Brussels and carry a voting right identical to that of the

ordinary shares.

The first series of preference shares was issued at 107.89 EUR and

the second at 104.40 EUR per share. The par value of both series is

53.33 EUR per share.

Shares held by the Group:

at 31.12.2015, the Group held 50,114 ordinary

shares (also see page 28) (31.12.2014: 54,414).

In accordance with the Law of 14.12.2005 dealing with the suppression

of bearer shares, as modified by the Law of 21.12.2013, the Company

proceeded to the sale of physical securities still in circulation and

received a report of its Auditor certifying the conformity of the imple-

mented procedure for this sale.

Authorised capital

The General Shareholders’ Meeting authorised the Board of

Directors on 29.03.2011 to issue new capital for an amount of

799,000,000 EUR and for a period of five years. At 31.12.2015, the Board

of Directors has made use of this authorisation for a total amount of

422,737,729.68 EUR. Hence, the remaining authorised capital amounts

to 376,262,270.32 EUR at that date. This authorised capital is based

on the par value of 53.33 EUR per ordinary or preference share before

31.12.2007 and 53.59 EUR per ordinary share subsequently.

With this authorisation expected to expire on 28.04.2016, the

Extraordinary General Meeting of 06.01.2016 conferred on the Board of

Directors a new authorisation for five years from the date of the publi-

cation of 03.02.2016 in the annexes of the Belgian Official Gazette/

Moniteur Belge) of the minutes of the Extraordinary General Meeting

of 06.01.2016.

The Board of Directors is authorised to increase the company’s

capital, at one or more times, up to a maximum amount of:

1°) 1,100,000,0.00 EUR, if the capital increase to be performed is

a capital increase by subscription in cash with the possibility of

exercising the preferential subscription right of the Company’s

shareholders,

2°) 220,000,000.00 EUR for all other forms of capital increase not

referred to in point 1°) above.

It being understood that in any case, the share capital may

never be increased as part of the authorised capital beyond

1,100,000,000.00 EUR in total.

193