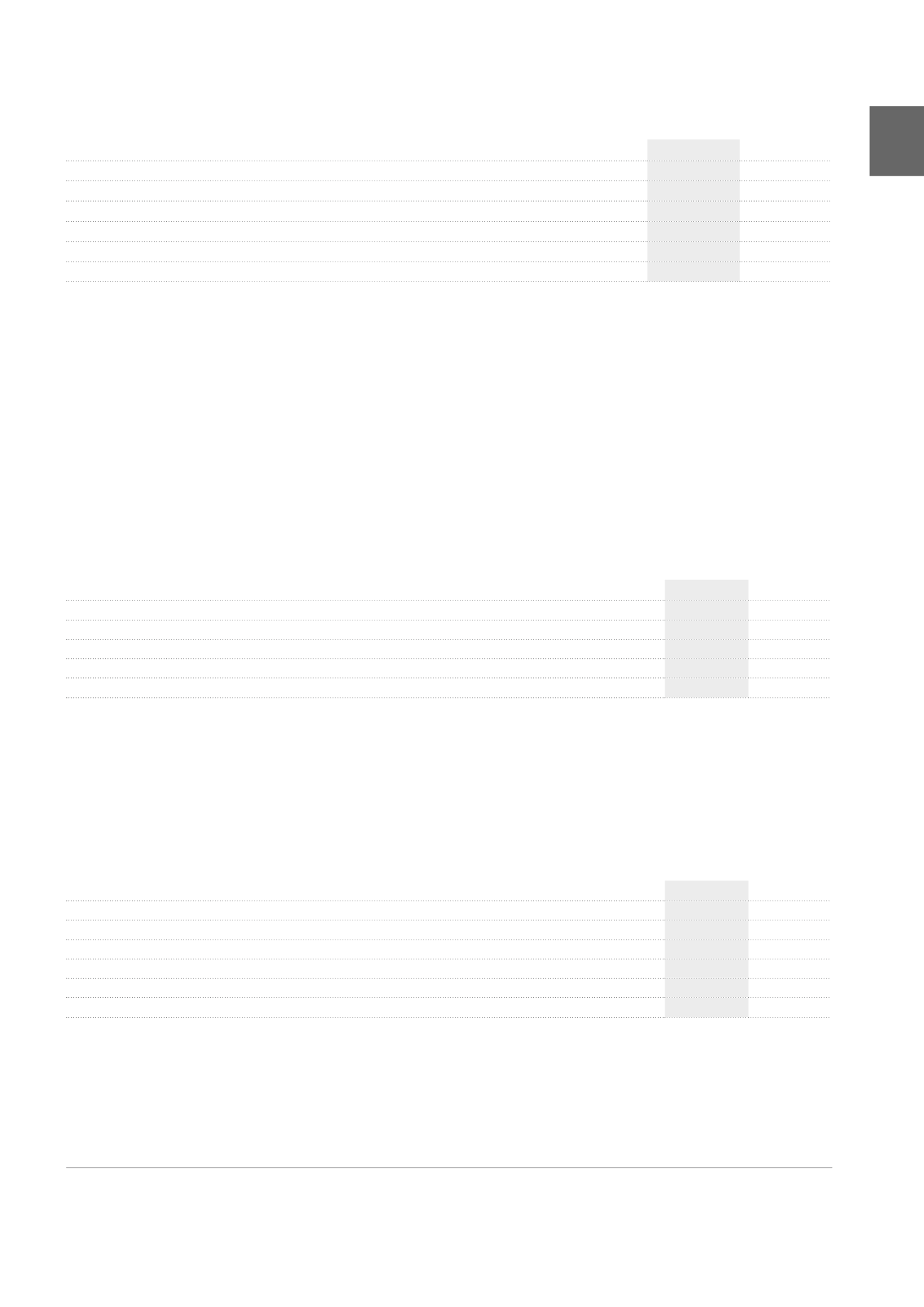

NOTE 34. PROVISIONS

(x 1,000 EUR)

2015

2014

AT 01.01

17,658

18,180

Provisions charged to the income statement

2,765

3,576

Uses

-1,477

-1,327

Provision writebacks credited to the income statement

-1,310

-2,771

AT 31.12

17,636

17,658

The provisions of the Group (17,636 K EUR) can be separated into

two categories:

•

contractual provisions defined according to IAS 37 as loss-making

contracts. Cofinimmo has committed to provide maintenance for

several buildings as well as works vis-à-vis tenants, with a total

cost of 13,382 K EUR (2014: 13,522 K EUR);

•

legal provisions to face its potential commitments vis-à-vis tenants

or third parties for 4,254 K EUR (2014: 4,136 K EUR).

These provisions correspond to the discounted future payments

considered as likely by the Board of Directors.

NOTE 35. DEFERRED TAXES

(x 1,000 EUR)

2015

2014

Exit tax

734

Deferred taxes Pubstone Properties

32,083

32,804

Deferred taxes Cofinimmo branch

2,341

1,990

Deferred taxes Aspria Maschsee

323

Deferred taxes Aspria Uhlenhorst

539

TOTAL

35,286

35,528

In 2014, the exit tax pertained to two French entities that opted for

the SIIC status in 2013. This exit tax is based upon the gains resulting

from the valuation of the properties, i.e. the difference between

the value of the properties as estimated by the expert at 31.12.2012

and the net book value of these properties at the same date. The

taxation rate applied to this figure stands at 19%. The payment of the

exit tax is spread over four years. The third payment took place in

December 2015 for a total amount of 626 K EUR. The final tranche is

incorporated into current debts (see Note 36).

The deferred taxes of the Dutch subsidiary

Pubstone Properties BV corresponds to the taxation, at a rate of 25%,

of the difference between the investment value of the assets, less

registration rights, and their tax value.

Since 2014, the Cofinimmo’s French branch is subject to a new tax, the

branch tax. A provision for deferred taxes had to be established.

1

Based on the parent company’s result.

2

The gross dividend for the new ordinary shares created following the capital increase of the 12.05.2015 is calculated on a pro rata basis at 3.54 EUR (net 2.58 EUR), which

represents the dividend of the period from 12.05.2015 till 31.12.2015.

3

17,289,946 ordinary shares entitled to the full result of financial year 2015 and 3,004,318 new ordinary shares created as part of the capital increase on 12.05.2015, entitled to the

result of financial year 2015 as from 12.05.2015.

NOTE 33. DIVIDEND PER SHARE

1

(in EUR)

Paid in 2015

Paid in 2014

Gross dividends attributable to the ordinary shareholders

95,067,764.00 101,431,248.00

Gross dividend per ordinary share

5.50

6.00

Net dividend per ordinary share

4.125

4.50

Gross dividends attributable to the preference shareholders

4,372,661.02

4,386,120.83

Gross dividend per preference share

6.37

6.37

Net dividend per preference share

4.7775

4.7775

A gross dividend in respect of the financial year 2015 for ordinary

shares of 5.50 EUR

2

per share (net dividend of 4.015 EUR per share),

amounting to a total dividend of 105,729,988.72 EUR, will be proposed

at the Ordinary General Meeting of 11.05.2016. At the closing date, the

number of ordinary shares entitled to the 2015 dividend stands at

20,294,264

3

.

The Board of Directors proposes to suspend the right to dividend for

the 40,225 own ordinary shares still held by Cofinimmo under its stock

option plan and to cancel the dividend right of the remaining 9,889

own shares.

A gross dividend in respect of the financial year 2015 of 6.37 EUR per

preference share (net dividend of 4.6501 EUR per preference share),

amounting to a total dividend of 4,368,851.76 EUR, is to be proposed

at the Ordinary General Meeting of 11.05.2016. Indeed, at the closing

date, the number of preference shares entitled to the 2015 dividend

stands at 685,848.

Since 01.01.2016, the withholding tax rate applicable to distributed

dividends stands at 27%. The Belgian Law provides for exemptions

that the beneficiaries of the dividends can rely on depending on their

status and the conditions that must be met to be eligible for them.

Moreover, the agreements to prevent double taxation provide for

reductions of withholdings at source on dividends.

195