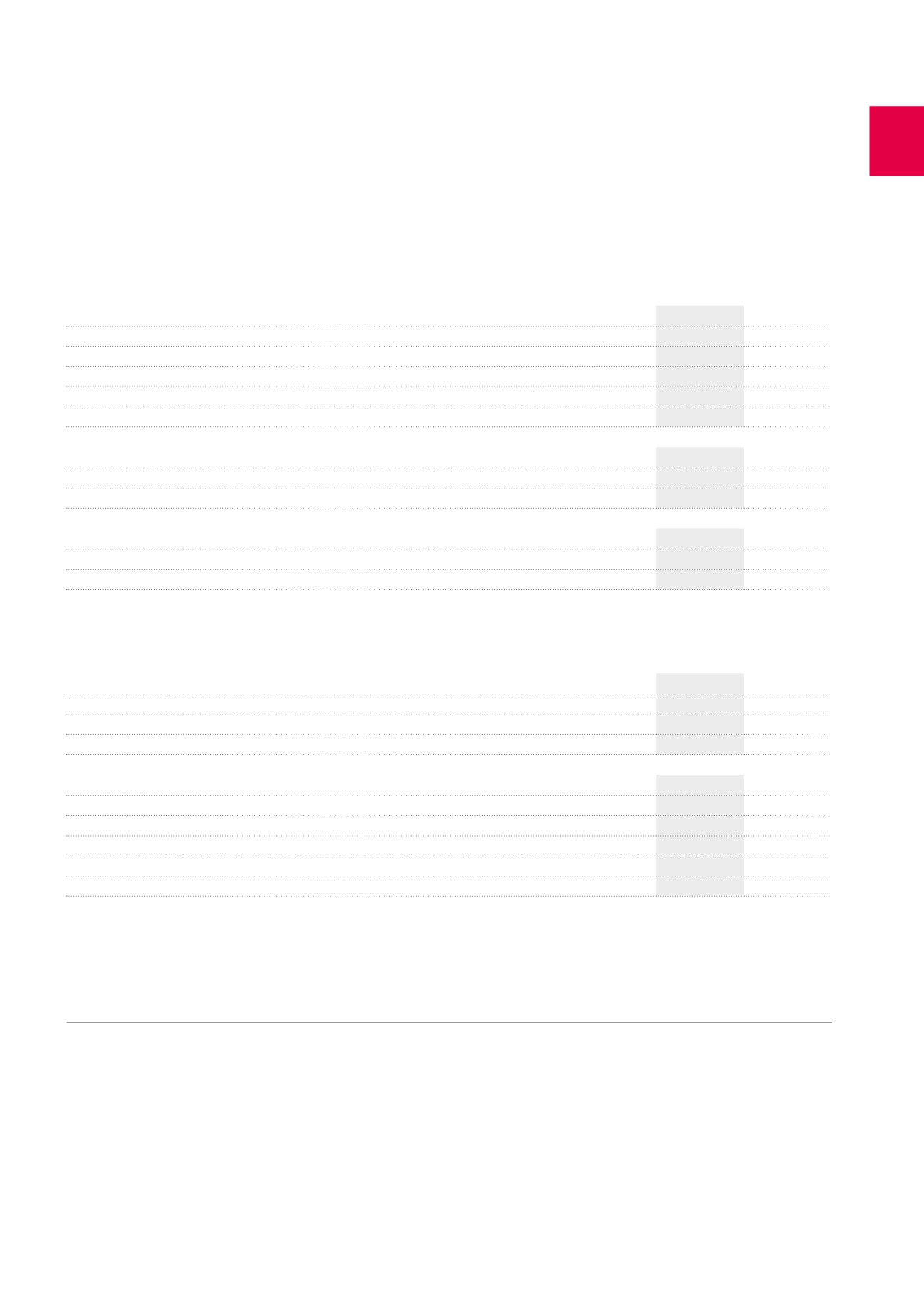

Figures per share

1

(in EUR)

Results per share

31.12.2015

31.12.2014

Net current result – Group share – excluding IAS 39 impact

6.46

6.70

IAS 39 impact

-1.55

-7.57

Net current result – Group share

4.91

-0.87

Result on the portfolio

0.32

-2.06

Net result – Group share

5.23

-2.93

Net Asset Value per share

31.12.2015

31.12.2014

Revalued Net Asset Value in fair value

2

after distribution of the dividend for financial year 2014

88.66

80.24

Revalued Net Asset Value in investment value

3

after distribution of the dividend for financial year 2014

92.24

84.52

Net Asset Value per share

4

31.12.2015

31.12.2014

Diluted revalued Net Asset Value in fair value

2

after distribution of dividend for financial year 2014

88.49

4

80.05

4

Diluted revalued Net Asset Value in investment value

3

after distribution of dividend for financial year 2014

92.06

4

84.33

4

1

Ordinary and preference shares.

2

Fair value: after deduction of transaction costs (mainly transfer taxes) from the value of investment properties.

3

Investment value: before deduction of transaction costs.

4

In accordance with applicable IFRS/IAS rules, the bonds redeemable in shares issued in 2011, and the convertible bonds issued in 2011 and 2013 are not taken into account in the

calculation of the diluted revaluated net book value per share at 31.12.2015 and at 31.12.2014, as they would have an earnings-enhancing effect. However, the stock options have been

taken into account in the calculation at 31.12.2015 and at 31.12.2014, as they had a dilutive effect.

5

These data are not compulsory according to the RREC regulation and are not subject to verification by public authorities. The auditor verified whether the “EPRA Earnings”, “EPRA NAV”

and “EPRA NNNAV” ratios are calculated according to the definitions included in the “EPRA Best Practices Recommendations” and if the financial data used in the calculation of these

ratios comply with the accounting data included in the audited consolidated financial statements. EPRA NAV calculations take into account the fair value of finance lease receivables;

the 2014 EPRA NAV ratios were modified as a result of this new calculation method.

6

EPRA diluted Result per share amounts to 6.46 EUR in 2015 and to 6.70 EUR in 2014. Indeed, in accordance with the “EPRA Best Practices Recommendations”, the bonds redeemable in

shares issued in 2011 and the convertible bonds issued in 2011 and 2013 being out-of-the-money at 31.12.2015 and at 31.12.2014, are not taken into account in the calculation of the EPRA

diluted Result of 2015 and 2014.

8

In accordance with the “EPRA Best Practices Recommendations”, the bonds redeemable in shares issued in 2011 and the convertible bonds issued in 2011 and 2013 being out-of-the-

money at 31.12.2015 and at 31.12.2014, are not taken into account in the calculation of the EPRA VAN and VANNN at these dates.

7

The calculation of the EPRA NAV and EPRA NNNAV was revised at the end of 2015 to take account of finance lease receivables, in accordance with the “EPRA Best Practices

Recommendations”. The EPRA NAV and EPRA NNNAV at 31.12.2014 were recalculated to take this item into account.

EPRA performance indicators

5

(in EUR per share)

31.12.2015

31.12.2014

EPRA Net recurring result

6.46

6

6.70

6

EPRA Net Asset Value (NAV)

7

93.34

8

93.59

8

EPRA Adjusted Net Asset Value (NNNAV)

7

90.93

8

88.66

8

(in %)

31.12.2015

31.12.2014

EPRA Net Initial Yield (NIY)

6.0%

6.1%

EPRA “Topped-up” NIY

5.9%

6.0%

EPRA Vacancy rate

5.2%

4.9%

EPRA Cost ratio (direct vacancy costs included)

20.1%

18.5%

EPRA Cost ratio (direct vacancy costs excluded)

17.7%

15.9%

17