1

Number of shares calculated on a pro rata basis to take account of the fact that the 3,004,318 new ordinary shares issued in May 2015 contribute to the result of financial year 2015

only from 12.05.2015.

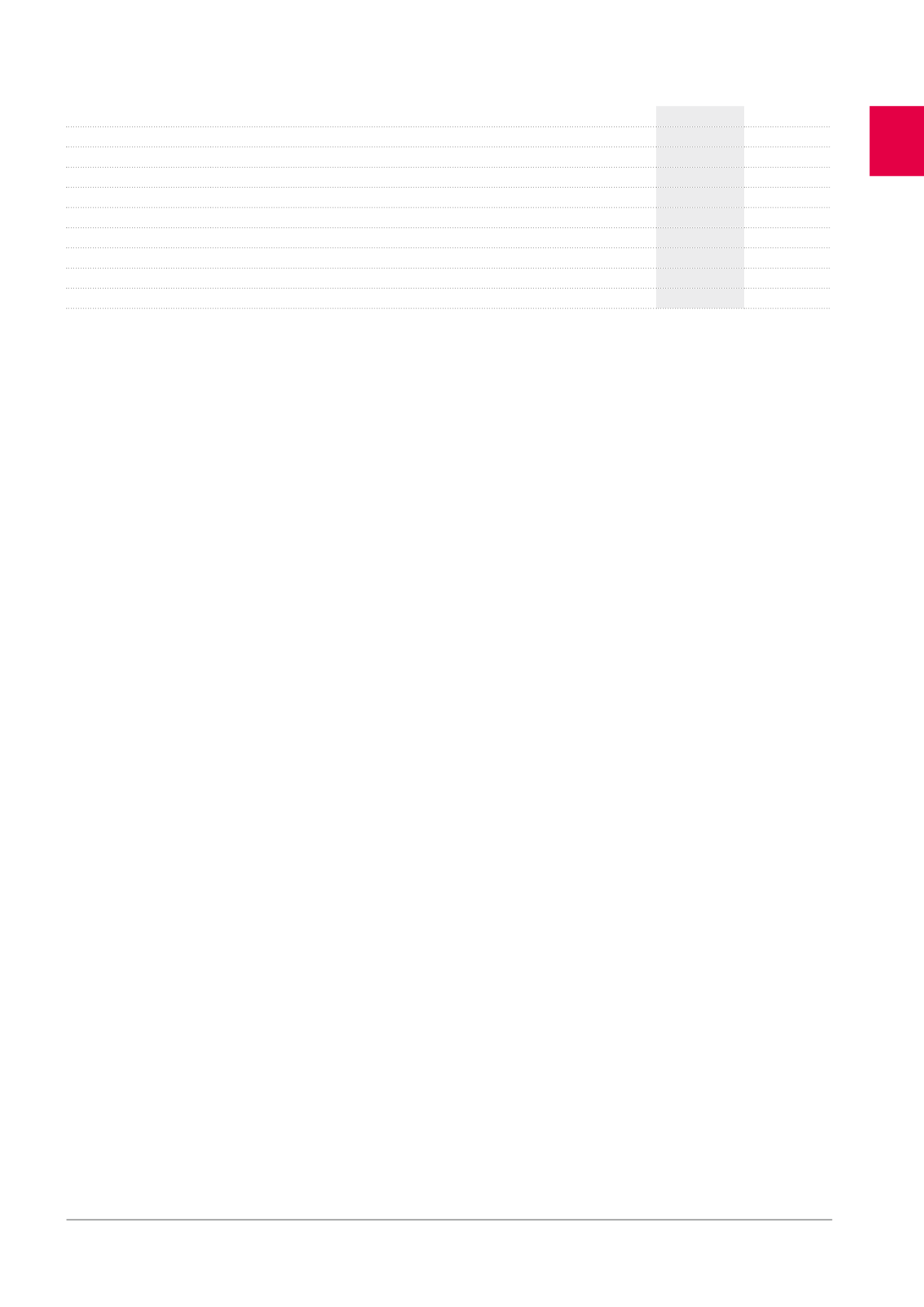

NUMBER OF SHARES

31.12.2015

31.12.2014

Number of ordinary shares issued (including treasury shares)

20,344,378

17,339,423

Number of ordinary shares outstanding

20,294,264

17,285,009

Number of sordinary hares used to calculate the earnings per share

19,202,531

17,285,009

Number of preference shares issued

685,848

686,485

Number of preference shares outstanding

685,848

686,485

Number of preference shares used to calculate the earnings per share

685,848

686,485

Total number of shares issued (including treasury shares)

21,030,226

18,025,908

Total number of shares outstanding

20,980,112

17,971,494

Total number of shares used to calculate the earnings per share

19,888,379

1

17,971,494

COMMENTS ON THE CONSOLIDATED INCOME STATEMENT –

ANALYTICAL FORM

Net rental income

amounts to 201.9 million EUR at 31.12.2015, up com-

pared with 31.12.2014 (195.8 million EUR). This improvement is mainly

the result of the acquisition of healthcare assets in the Netherlands

and Germany. The item “Writeback of lease payments sold and

discounted” decreased from 15.9 million EUR at 31.12.2014 to 10.2 mil-

lion EUR at 31.12.2015, primarily as a result of the sale of the North

Galaxy office building on 12.05.2014. The

property result

amounts

to 207.5 million EUR at 31.12.2015, compared with 208.1 million EUR at

31.12.2014.

The increase of technical costs is mainly due to stricter technical

regulations, to assets acquisition in the Netherlands and Germany, and

to the rising demand for smaller office spaces.

Direct and indirect operating costs represent 0.93% of the average

value of the assets under management at 31.12.2015, compared with

0.85% at 31.12.2014. The

operating result (before result on portfolio)

was 174.3 million EUR at 31.12.2015, compared with 177.7 million EUR one

year earlier.

The

financial result (excluding IAS 39 impact)

amounts to -37.2 mil-

lion EUR at 31.12.2015, compared with -51.4 million EUR at 31.12.2014.

The average cost of debt decreases from 3.4% at 31.12.2014 to 2.9%

at 31.12.2015, thanks to the cancellation of COLLARs and refinancing

under advantageous conditions. The average debt level amounts to

1,459.0 million EUR at 31.12.2015, compared with 1,593.4 million EUR at

31.12.2014.

The item

“Revaluation of financial instruments”

stands at -30.4 mil-

lion EUR at 31.12.2015, compared with -136.1 million EUR at 31.12.2014.

It includes a charge related to restructuring interest rate hedging

instruments for -19.0 million EUR, the effect of revaluing hedging instru-

ments that have not been restructured for -5.3 million EUR, as well as

the effect of revaluing convertible bonds for -6.1 million EUR.

Taxes

increased from -2.5 million EUR at 31.12.2014 to -4.2 million EUR at

31.12.2015. The 2014 figures were positively affected by the recovery of

certain taxes (non-recurring item).

The

net current result – Group share

amounts to 97.7 million EUR at

31.12.2015, compared with -15.7 million EUR at 31.12.2014. Per share,

these numbers were 4.91 EUR at 31.12.2015 and -0.87 EUR at 31.12.2014.

Within the result on the portfolio,

gains or losses on disposals of

investment properties and other non-financial assets

amount to

22.4 million EUR at 31.12.2015, compared with -22.4 million EUR at

31.12.2014. The 2015 figures reflect the gains realised on the sales of

the Group’s holdings in Livingstone II and Silverstone. The 2014 figures

had been negatively impacted by the accounting loss caused by the

registration fees paid as part of the sale of the North Galaxy office

building.

The

change in the fair value of investment properties

amounts

to -8.6 million EUR at 31.12.2015, compared with -5.4 million EUR at

31.12.2014. The decrease in value of office buildings to be renovated in

the near future is partially offset by the improved value of healthcare

assets. On a like-for-like basis, the fair value of investment properties

slightly decreased since 31.12.2014 (-0.3%).

The

net result – Group share

amounts to 104.0 million EUR at 31.12.2015,

compared with -52.7 million EUR at 31.12.2014. Per share, these num-

bers were 5.23 EUR at 31.12.2015 and -2.93 EUR at 31.12.2014.

23