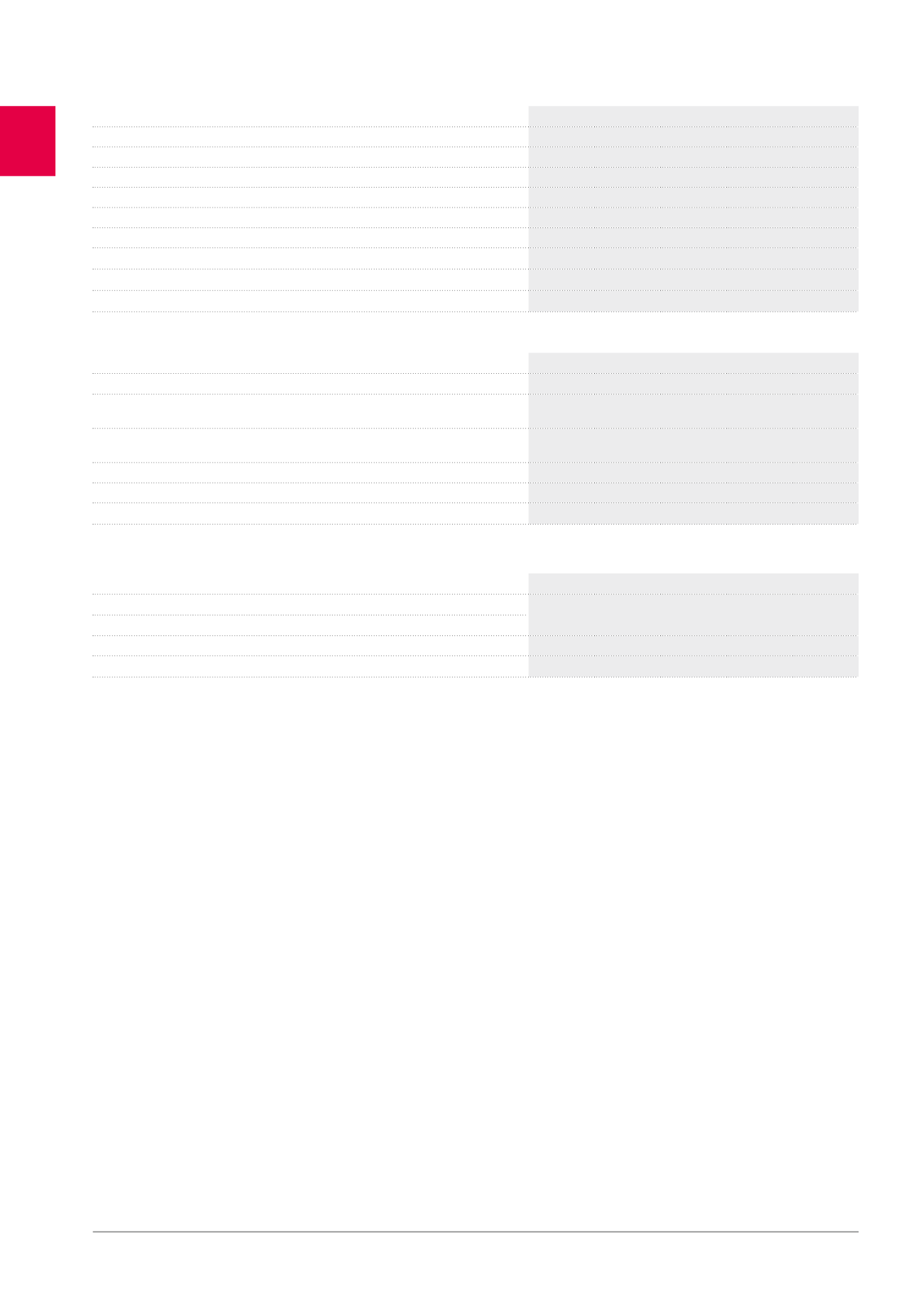

(x1,000EUR)

Q1 2015 Q2 2015 Q3 2015 Q4 2015

2015

1

B. OTHER ELEMENTS OF THE GLOBAL RESULT RECYCLABLE UNDER THE INCOME STATEMENT

Changes in the effective part of the fair value of authorised cash flow hedge

instruments

1,350

1,886

814

-406

3,644

Impact of the restructuring of the hedging instruments which relationship has been

terminated

6,426

1,576

1,578

19,985

29,565

Other elements of the global result

7,776

3,462

2,392

19,579 33,209

Minority interests

OTHER ELEMENTS OF THE GLOBAL RESULT - GROUP SHARE

7,776

3,463

2,392 19,579 33,209

(x1,000EUR)

Q1 2015 Q2 2015 Q3 2015 Q4 2015

2015

1

C. GLOBAL RESULT

Global result

3,662 67,353 22,773 47,870 141,658

Minority interests

-1,159

-1,551

-1,186

-586

-4,482

GLOBAL RESULT – GROUP SHARE

2,503 65,802 21,587

47,284 137,176

(x1,000EUR)

Q1 2015 Q2 2015 Q3 2015 Q4 2015

2015

1

Pre-tax result

-3,044 65,526

21,005 28,924 112,410

Corporate tax

-967

-1,662

-719

-861

-4,209

Exit tax

-103

27

96

228

248

Taxes

-1,069

-1,635

-623

-633

-3,961

Net result

-4,113 63,890 20,382

28,291

108,449

Minority interests

-1,159

-1,551

-1,186

-586

-4,482

NET RESULT - GROUP SHARE

-5,272 62,339 19,196 27,704 103,967

NET CURRENT RESULT - GROUP SHARE

1,038

63,111

20,279 13,278 97,706

RESULT ON THE PORTFOLIO - GROUP SHARE

-6,310

-772 -1,083 14,426

6,261

1

The half-year and annual figures are verified by the Auditor Deloitte, Company Auditors.

26

Management report /

Summary of quarterly consolidated accounts