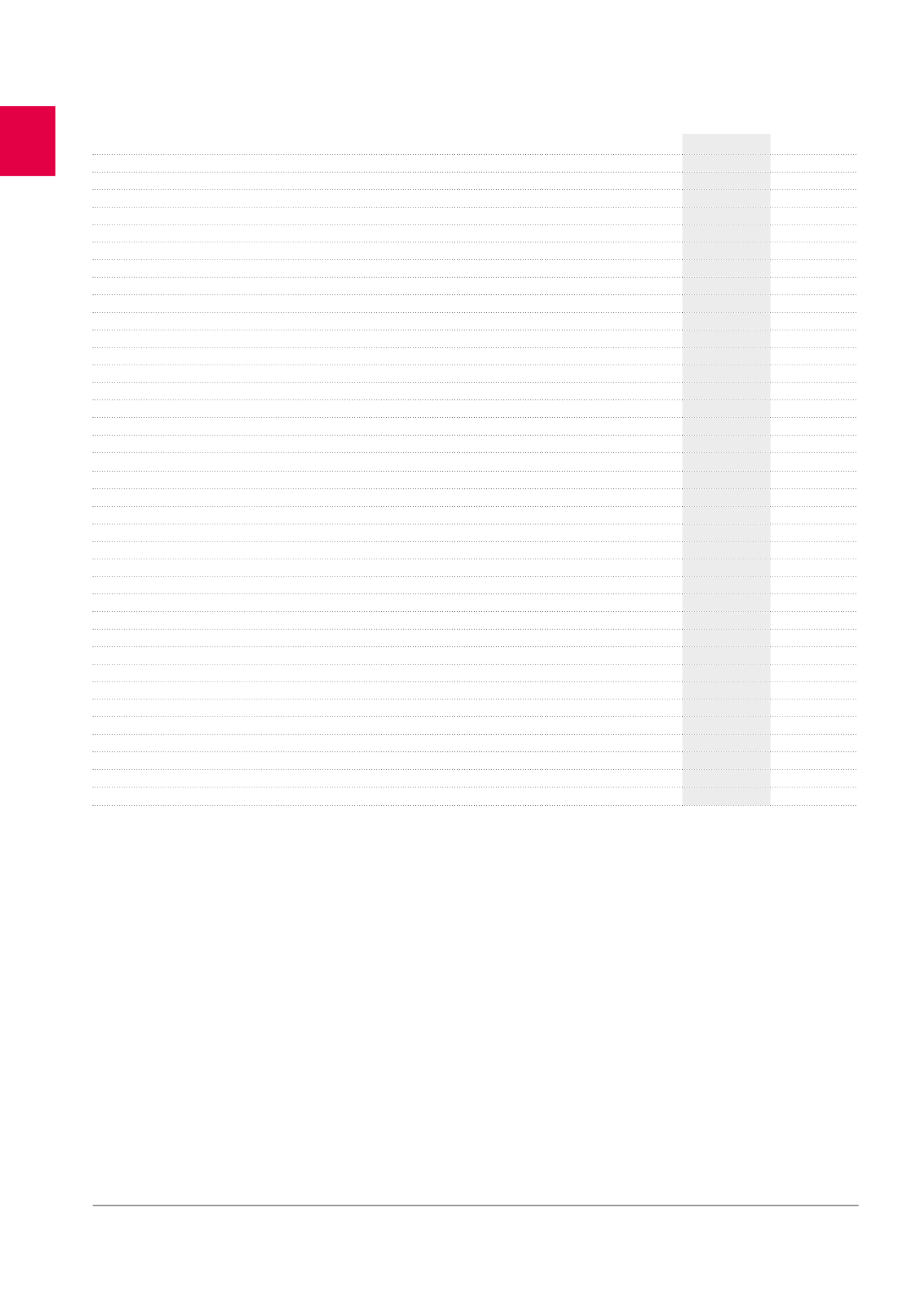

Consolidated balance sheet

(x 1,000 EUR)

31.12.2015

31.12.2014

Non-current assets

3,325,414

3,410,050

Goodwill

111,256

118,356

Intangible assets

565

659

Investment properties

3,131,483

3,195,773

Other tangible assets

364

411

Non-current financial assets

20

10,933

Finance lease receivables

75,652

78,018

Trade receivables and other non-current assets

41

38

Participations in associated companies and joint ventures

6,033

5,862

Current assets

87,066

88,962

Assets held for sale

2,870

3,410

Current financial assets

14

498

Finance lease receivables

1,656

1,618

Trade receivables

19,801

24,781

Tax receivables and other current assets

17,363

17,505

Cash and cash equivalents

22,040

17,117

Accrued charges and deferred income

23,322

24,033

TOTAL ASSETS

3,412,480

3,499,012

Shareholders’ equity

1,924,615

1,608,965

Shareholders’ equity attributable to shareholders of parent company

1,860,099

1,541,971

Capital

1,124,295

963,067

Share premium account

504,240

384,013

Reserves

127,597

247,562

Net result of the financial year

103,967

-52,671

Minority interests

64,516

66,994

Liabilities

1,487,865

1,890,047

Non-current liabilities

926,891

1,303,250

Provisions

17,636

17,658

Non-current financial debts

809,313

1,148,023

Other non-current financial liabilities

64,656

102,041

Deferred taxes

35,286

35,528

Current liabilities

560,974

586,797

Current financial debts

445,676

473,499

Other current financial liabilities

20,572

24,698

Trade debts and other current debts

62,865

59,850

Accrued charges and deferred income

31,861

28,750

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES

3,412,480

3,499,012

COMMENTS ON THE CONSOLIDATED BALANCE SHEET

The test of

goodwill

depreciation resulted in a depreciation of 7.1 mil-

lion EUR on the goodwill of Pubstone Belgium and the Netherlands.

The

investment value

of the property portfolio

1

, as determined by the

independent real estate experts, was 3,262.3 million EUR at 31.12.2015,

compared with 3,329.2 million EUR at 31.12.2014. Its

fair value

, shown

on the consolidated balance sheet, by application of IAS 40, is

obtained by deducting transaction costs from the investment value

2

.

At 31.12.2015, the fair value was 3,134.4 million EUR, compared with

3,199.2 million EUR at 31.12.2014.

The drop of

non-current financial assets

is explained by the repay-

ment of the long-term debt relating to the reconversion project of the

Livingstone I building. The

currect financial assets

adopt the value of

the current IRS hedging instruments.

The item

“Participations in associated companies and joint ven-

tures”

concerns Cofinimmo’s 51% stake in Cofinéa I SAS (medical

residences in France). The item

“Minority interests”

includes the man-

datory convertible bonds issued by the Cofinimur I SA/NV subsidiary

(MAAF/GMF retail network in France), as well as the minority interests

of the Pubstone Group, Pubstone and Rheastone subsidiaries.

The decrease of

non-current financial liabilities

is linked to the capital

increase of May 2015 resulting in a repayment of a part of the debt.

The decrease of

other non-current financial liabilities

is linked to the

restructuring of financial hedging instruments. The drop of reserves

is mainly explained by the appropriation of the 2014 result and the

dividends paid for the financial year 2014.

1

Including assets held for own use and development projects.

2

Since 01.01.2015, the transaction costs upon an acquisition or investment, as well as all variation of the real value of buildings during the current year, are recognised dierectly in the

income statement. The rights accounted before 01.01.2015 according to the old method have not been restated. See also page 160 of this Annual Financial Report.

24

Management report /

Summary of consolidated accounts