2016

2017

2018

2019

2020

2021

2022

353.3

171.0

100.0

146.0

10.0 100.0

445.0

250.0

200.0

204.0

291.0

0

200

400

600

1,200

1,000

800

600

400

200

0

3.0

2.5

2.0

1.5

1.0

0.5

0

2016 2017

2019

2021

2018

2020

2022

1.44% 1.44%

2.35% 2.33%

1.96%

2.33% 2.40%

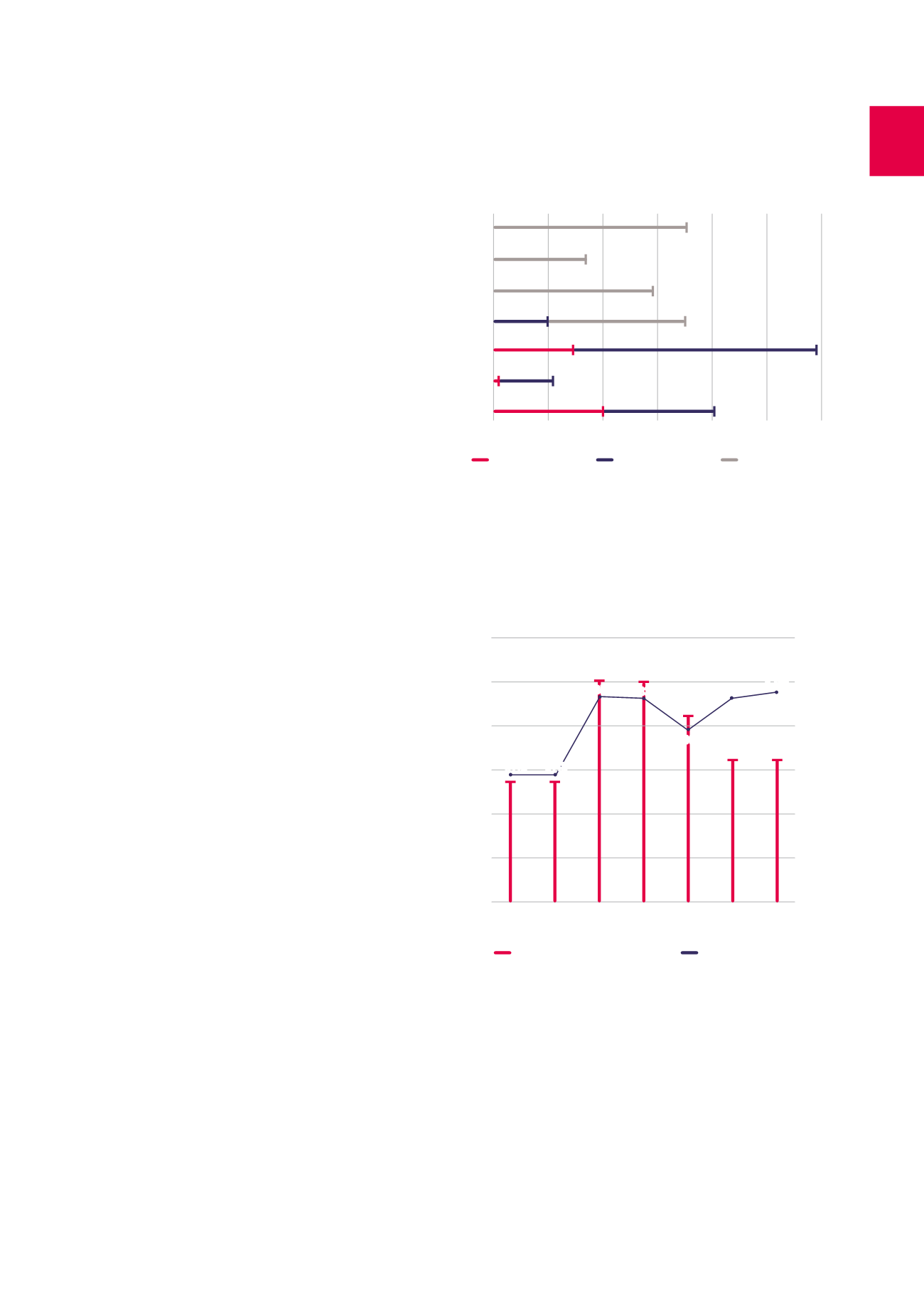

Situation of long-term financial

commitments

The weighted average maturity of Cofinimmo’s financial commitments

has increased to 5.3 years at 31.12.2015 versus 3.4 years at the end of

2014. This calculation excludes short-term maturities of commercial

papers, which are fully covered by the undrawn portions of long-term

credit facilities. The calculation also does not account for maturities for

which refinancing is already in place. The long-term confirmed finan-

cial credit lines (bank lines, bonds, commercial papers of over one year

and capital leases), with outstandings totalling 2,280.0 million EUR on

31.12.2015, have a homogeneously spread maturity profile up to 2022,

with a maximum of 26% of these outstandings maturing during the

same year, in this case 2020.

Interest rate hedging

Cofinimmo’s average cost of debt, including bank margins, stood at

2.9% during financial year 2015, versus 3.4% during financial year 2014

(also see Note 16).

At 31.12.2015, the majority of the debt was at fixed rate. This part

is composed of convertible bonds of 387.6 million EUR, including

174.8 million EUR maturing in 2016, and private placements of non-con-

vertible bonds totalling 380 million EUR.

Given that the other part of the debt was at a short-term floating

rate, the company is exposed to a risk of a rise in rates, which could

have a negative impact on its financial result. That is why Cofinimmo

simultaneously uses partial hedging of its global debt through hedging

instruments such as Interest Rate Swaps (IRS) – see the “Risk Factors”

chapter of this Annual Financial Report on page 8).

In 2015, Cofinimmo used Interest Rate Swaps to establish new hedges

for the 2020-2022 period:

•

IRS, covering 2020, for a notional amount of 350 million EUR, with a

strike rate of 0.85%;

•

IRS, covering 2021, for a notional amount of 150 million EUR, with a

strike rate of 1%;

•

IRS, covering 2022, for a notional amount of 150 million EUR, with a

strike rate of 1.31%.

Repayment schedule for long-term financial commitments -

2,280 million EUR (x 1,000,000 EUR)

Equity market

Bank facilities

Refinanced

Situation of interest rate hedging in future years

(x 1,000,000 EUR)

(in %)

Notional amount

Weighted average rate

81