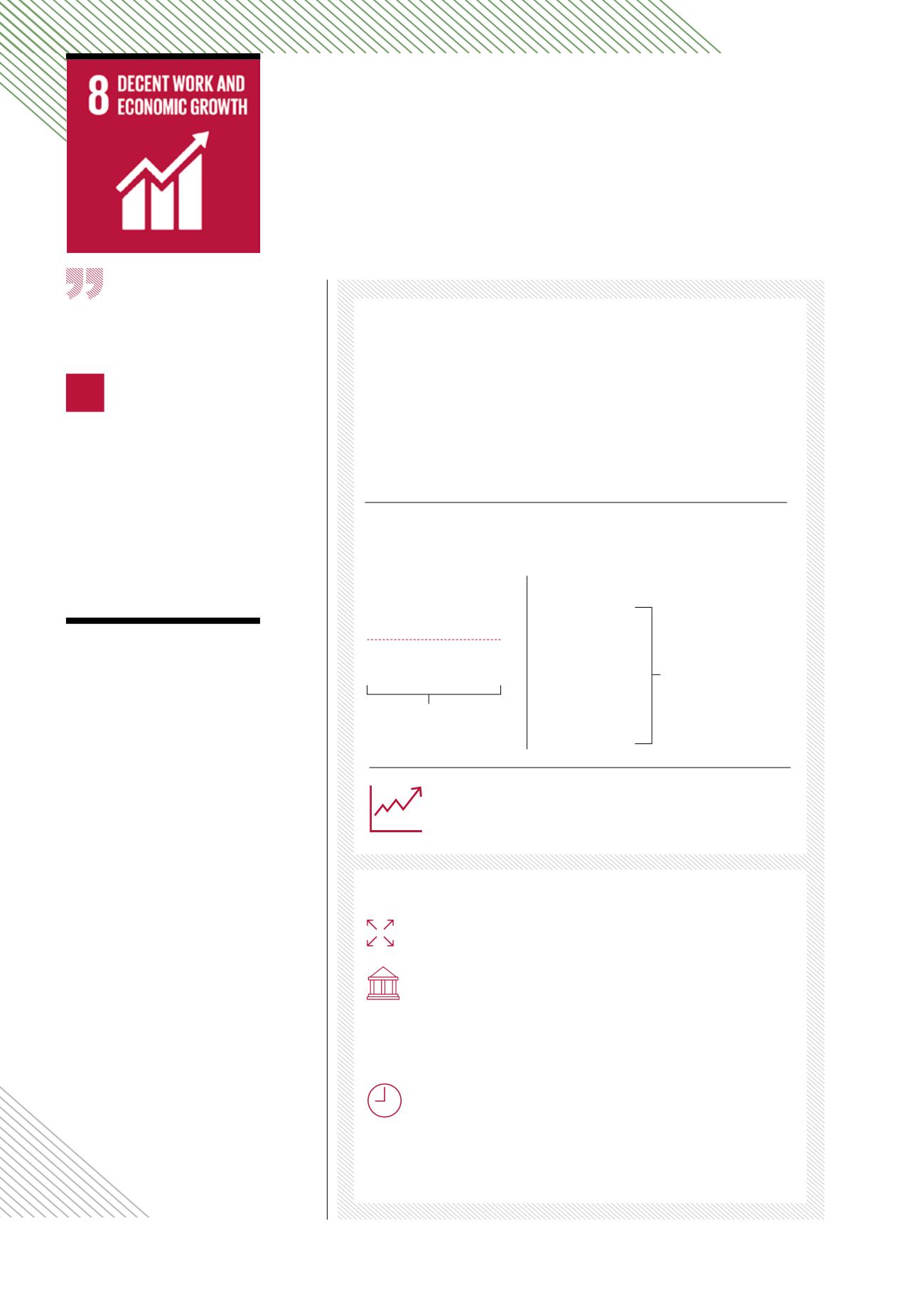

OUR 2017 PERFORMANCE INDICATORS

93.26

EUR

Net asset value per share

(at fair value)

6.53

EUR

Net result from core

activities per share

1.9%

Average cost of debt

5.50

EUR

2017 gross dividend payable in

in 2018 per ordinary share

OUR 2018 OBJECTIVES

DIVERSIFICATION

Diversification of financial resources

CAPITAL MARKETS

Regular recourse to capital markets

45%

Approximate debt ratio

DURATION AND COST OF DEBT

Optimisation of the duration and cost of financing

5.50

EUR

Gross 2018 dividend payable in 2019 per ordinary share

9,080

EUR

Economic value retained within the Group (x 1,000 EUR)

ECONOMIC VALUE GENERATED

AND DISTRIBUTED IN 2017

ECONOMIC VALUE GENERATED

(X 1,000 EUR)

ECONOMIC VALUE DISTRIBUTED

(X 1,000 EUR)

210,899

EUR

Customers

-19,566

EUR

Personnel

25,407

EUR

Suppliers of goods

and services

-171,477

EUR

Total economic

value distributed

(X 1,000 EUR)

-120,502

EUR

Shareholders

185,492

EUR

Value added

-30,552

EUR

Financial expenditure

-5,791

EUR

Public sector

+

-

=

PROMOTE INCLUSIVE

AND SUSTAINABLE

ECONOMIC GROWTH,

EMPLOYMENT AND DECENT

WORK FOR ALL

8.2

ACHIEVE HIGHER LEVELS OF

ECONOMIC PRODUCTIVITY

THROUGH DIVERSIFICATION,

TECHNOLOGICAL UPGRADING

AND INNOVATION, INCLUDING

THROUGH A FOCUS ON HIGH-

VALUE ADDED AND LABOUR-

INTENSIVE SECTORS.”

– UNITED NATIONS -

OUR ACTION

FIELD

PROFITABILITY FOR INVESTORS

AND ACCESS TO CAPITAL

Profitability is essential to allow our

company to assume its responsibilities

and pursue its activity. It measures both

the efficiency and the value that clients

grant to Cofinimmo’s products and

services. It determines the allocation

of resources and preservation of

the investments which condition its

development and the production of its

services. We cannot fully assume our

economic and social role if profits are

insufficient or our financial base is fragile.

46

\\ COFINIMMO \\

OUR ACTION FIELDS CORRESPONDING WITH THE SUSTAINABLE DEVELOPMENT GOALS