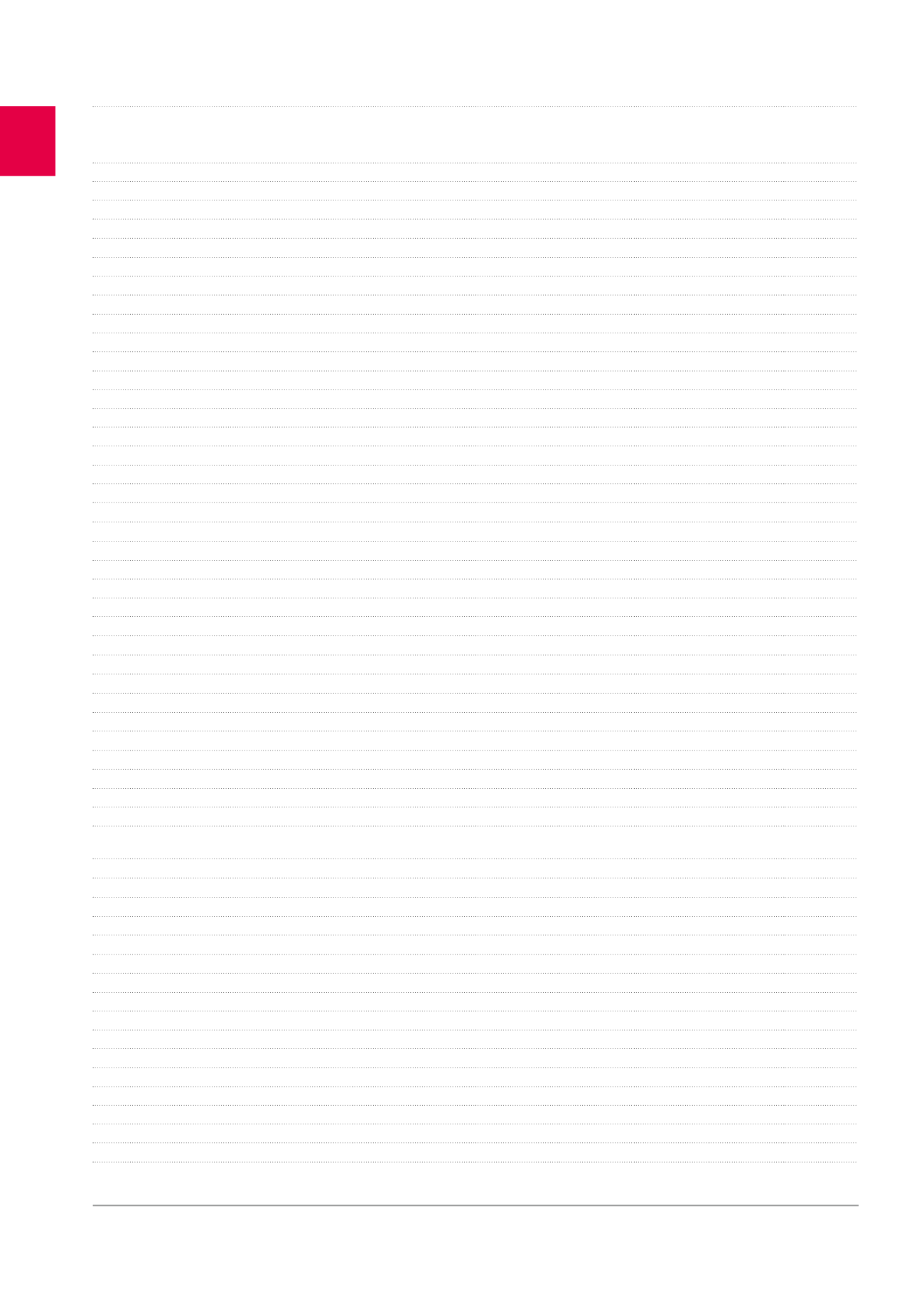

Property

Year of construction/

last renovation

(extension)

Superstructure

(in m²)

A Contractual

rents

(x 1,000EUR)

C=A/B

1

occupancy

rate

B Rents +

ERV on unlet

premises

(x 1,000EUR)

Estimated

rental value

2

(x 1,000EUR)

ALBERT I

er

4 - CHARLEROI

1967 (2005)

19,189

2,706

100%

2,706

2,712

MECHELEN STATION - MECHELEN

2002

28,708

4,584

100%

4,599

4,387

OFFICE BUILDINGS WITH SOLD RECEIVABLES

102,725

11,072

100%

11,080

11,080

Central Business District (CBD)

52,878

4,443

100%

4,443

4,443

EGMONT I*

1997

36,616

3,144

100%

3,144

3,144

EGMONT II*

2006

16,262

1,299

100%

1,299

1,299

Decentralised Brussels

20,199

2,075

100%

2,076

2,076

COLONEL BOURG 124*

1988 (2009)

4,137

234

99%

235

235

EVEREGREEN

1992 (2006)

16,062

1,841

100%

1,841

1,841

Brussels Leopold & Louise districts

26,188

3,885

100%

3,892

3,892

LOI 56

2008

9,484

1,472

100%

1,478

1,478

LUXEMBOURG 40

2007

7,522

895

100%

895

895

NERVIENS 105

1980 (2008)

9,182

1,425

100%

1,425

1,425

MEEÛS 23 (+ parking)

2010

93

98%

95

95

Other regions

3,460

669

100%

669

669

MAIRE 19 - TOURNAI*

1997

3,460

669

100%

669

669

PROPERTY OF DISTRIBUTION NETWORKS

417,111

37,616

98%

38,384

35,620

Pubstone

357,510

29,850

98%

30,358

27,317

Pubstone Belgium (791 buildings)*

309,557

19,672

99%

19,944

18,225

Brussels

41,609

3,644

99%

3,674

3,454

Flanders

193,166

11,609

99%

11,769

11,146

Wallonia

74,782

4,419

98%

4,501

3,625

Pubstone Pays-Bas (244 buildings)*

47,953

10,178

98%

10,414

9,092

Cofinimur I (279 buildings)*

59,601

7,766

97%

8,026

8,303

OTHER

15,830

1,802

100%

1,802

1,636

Antwerp Periphery

61

7

100%

7

8

AMCA - LONDON TOWER

2010

61

7

100%

7

8

Brussels Periphery

6,124

528

100%

528

398

MERCURIUS 30

2001

6,124

528

100%

528

398

Other regions

9,645

1,267

100%

1,267

1,230

KROONVELDLAAN 30 - DENDERMONDE

2012

9,645

1,267

100%

1,267

1,230

TOTAL INVESTMENT PROPERTIES AND WRITEBACK OF

LEASE PAYMENTS SOLD AND DISCOUNTED

1,700,407

210,068

95% 221,450

217,285

HEALTHCARE REAL ESTATE PROJECTS AND RENOVATIONS

2

2

2

Belgium

2

2

2

DIAMANT - SCHAERBEEK/SCHAARBEEK (BRUSSELS)

2

2

2

France

CAUX DU LITTORAL - NEVILLE*

Netherlands

DE PLATAAN - HEERLEN*

MOERBEILAAN-ALPHEN AN DEN RIJN*

OFFICE PROJECTS AND RENOVATIONS

28,637

BELLIARD 40

17,722

SOUVERAIN 24

3,897

WOLUWE 106-108

7,018

LAND RESERVE HEALTHCARE RELA ESTATE

22

22

22

1

The occupancy rate is calculated as follows: contractual rents divided by rents + ERV on unlet spaces.

2

The determination of the estimated rental value takes into account market data, the property’s location, its quality, the number of beds for healthcare assets and, if available, the

tenant’s financial data (EBITDAR).

102

Property Report /

CONSOLIDATED REAL ESTATE PORTFOLIO