\ 21

Appropriation of Company Results \

Management Report

1

These transfers result from the realisation of latent gains or losses previously under the reserves for changes in the fair value, as well as from purchase or cancellation transactions of

own shares.

2

The result to be carried forward includes the result to be carried forward of the year and of the previous years.

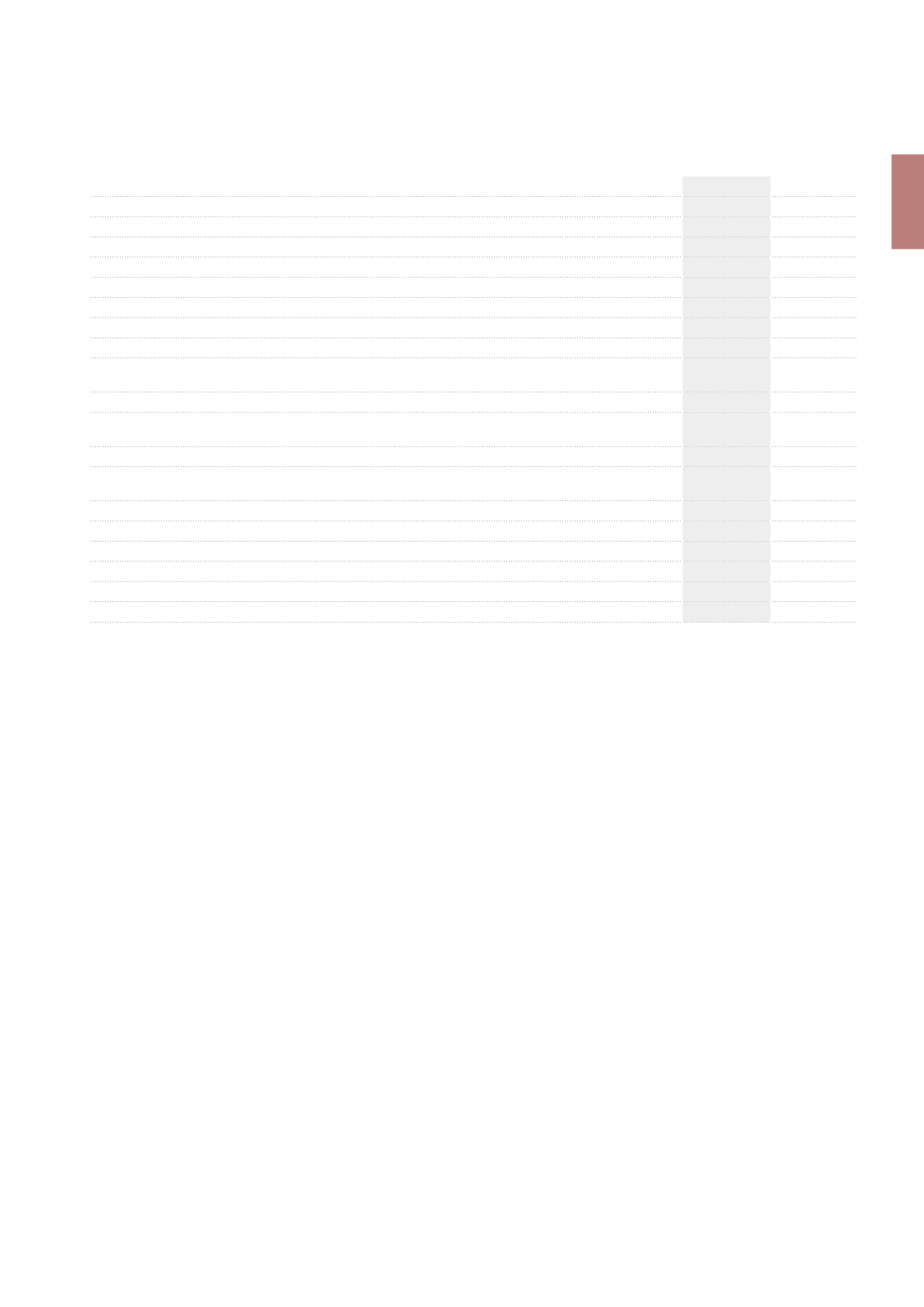

Appropriation account

(x €1,000)

2013

2012

A. Net Result

57,180

96,035

B. Transfert from/to the reserves

48,984

15,171

Transfer from/to the reserve of the positive balance of the changes in the fair value of investment properties

-32,242

-28,614

Fiscal year

-28,614

Previous years

1

-32,242

Transfer from/to the reserve of the negative balance of the changes in the fair value of investment properties

4,445

4,887

Fiscal year

4,445

Previous years

1

4,887

Transfer from/to the reserve of the estimated transaction costs

resulting from the hypothetical disposal of investment properties

1,146

175

Fiscal year

1,146

175

Transfer from/to the reserve of the balance of the changes

in the fair value of authorised cash flow hedging instruments qualifying for hedge accounting

-4,576

-11,080

Fiscal year

-4,576

-11,080

Transfer from/to the reserve of the balance of the changes

in the fair value of authorised cash flow hedging instruments not qualifying for hedge accounting

-18,643

13,421

Fiscal year

-18,643

13,421

Transfer from/to other reserves

-241

-255

Transfer from/to the result carried forward of the financial year

99,095

36,637

C. Remuneration of the capital

-105,817

-110,813

D. Remuneration of the capital other than C

-347

-394

E. Result to be carried forward

2

350,446

454,751