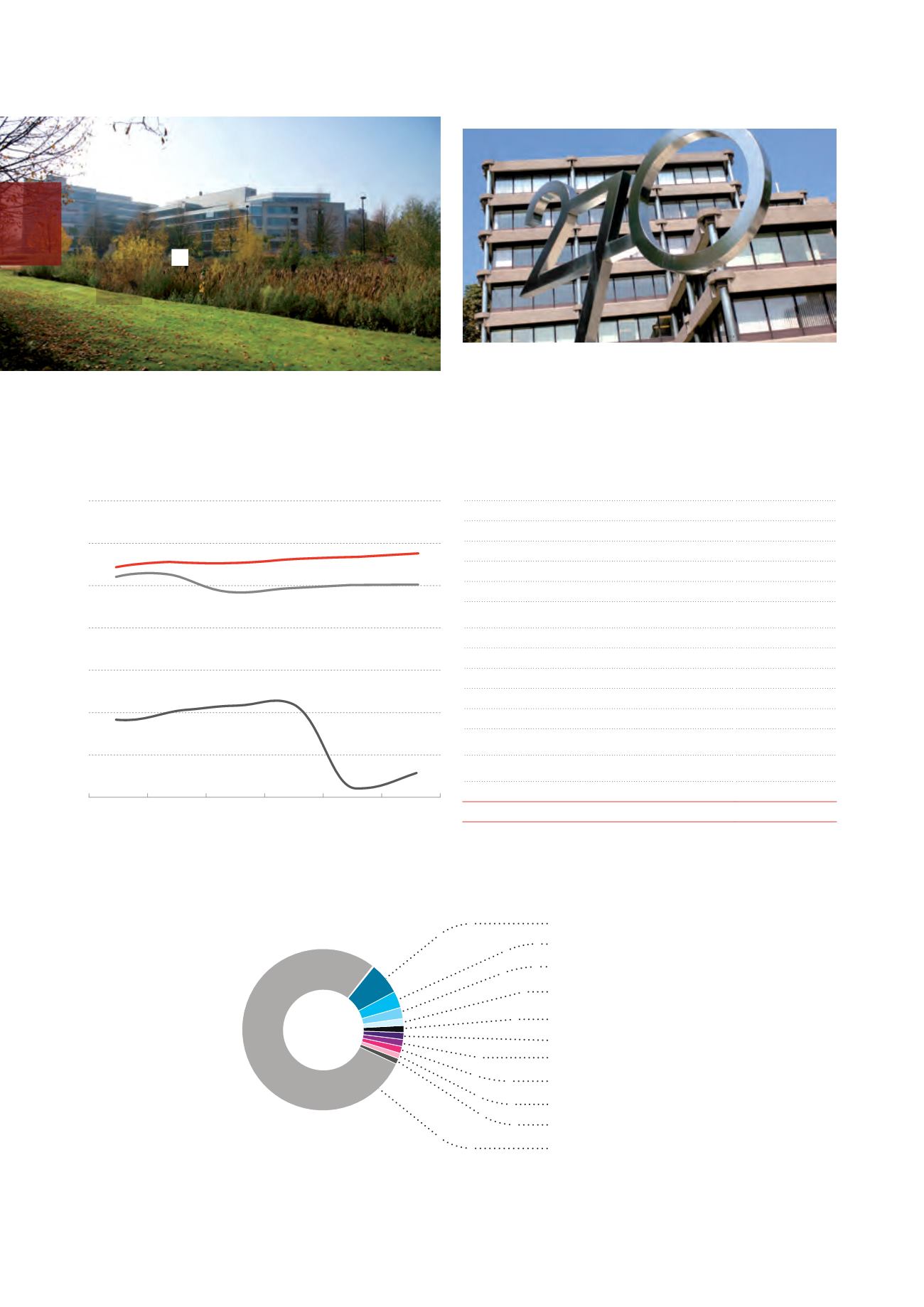

Capitalisation rates applied on the Cofinimmo portfolio and

yield of the Belgian government bonds

(in %)

Main clients - in contractual rents

(in %)

AB InBev Group

13.5%

Buildings Agency (Belgian Federal State)

12.6%

Medica

1

/Senior Living Group

8.6%

Armonea

8.4%

Korian

1

7.7%

Top 5 tenants

50.8%

Axa Group

5.2%

International public sector

4.6%

ORPEA

4.1%

MAAF

3.5%

Senior Assist

3.0%

Top 10 tenants

71.2%

Top 20 tenants

81.2%

Other tenants

18.8%

TOTAL

100.0%

Relative importance of the main buildings - in fair value

(in %)

1

In November2013, Korian and Medica announced their plan to merge during 2014.

North Galaxy

6.4%

Souverain/Vorst 23-25

3.4%

Egmont I

2.2%

Bourget 42

1.6%

Georgin 2

1.4%

Tervuren 270-272

1.4%

Serenitas

1.3%

Albert Ier 4 - Charleroi

1.3%

Cockx 8-10

1.1%

Damiaan - Tremelo

1.1%

Other

78.8%

9

8

7

6

5

4

3

2

Cofinimmo Office portfolio

7.77%

Cofinimmo Total portfolio

7.03%

Belgian government 10-year bond

2.68%

2008

2009

2010

2011

2012

2013

Bourget 40 – Brussels

Tervueren/Tervuren 270-272 – Brussels

26

/

Management Report /

Global Portfolio