14

12

10

8

6

4

12.5

11.6

6.9

2007

2008

2009

2010

2011

2012

2013

PROPERTY RESULTS

The Cofinimmo portfolio records a negative change in fair value of -0.8%

1

over the 12 months of 2013, corresponding to an amount of €-26.3 million.

The change in the portfolio value was negative during the four quarters

of 2013.

This depreciation is made up as follows:

•

the “Office” segment records a negative change in fair value of

€-39.7 million;

•

the segments “Healthcare real estate”, “Property of distribution

networks“ and “Others” record a positive change in fair value of

€9.8 million, €2.6 million and €1.0 million respectively.

The depreciation of the office portfolio comes from buildings under renova-

tion or requiring a significant renovation in the short term. This is the case

for the Livingstone II (works started in 2014), Science/Wetenschap 15-17,

Souverain/Vorst 23-25, Arts/Kunsten 19H, and Guimard 10-12 buildings.

Segment

Changes in

the fair value

over one year

Breakdown

by segment

and location

Offices

-2.54%

45.56%

Antwerp

-0.90%

1.86%

Brussels Centre/North

0.21%

9.48%

Brussels Decentralised

-2.84%

17.68%

Brussels Leopold/Louise District

-7.03%

8.92%

Brussels Periphery & Satellites

-1.59%

4.29%

Other Regions

2.22%

3.33%

Healthcare real estate

0.81%

36.70%

Belgium

0.82%

23.66%

France

0.70%

12.50%

Netherlands

3.05%

0.54%

Property of distribution networks

0.49%

15.92%

Pubstone - Belgium

0.33%

8.13%

Pubstone - Netherlands

0.26%

4.50%

Cofinimur I - France

1.23%

3.28%

Other

1.67%

1.82%

TOTAL PORTFOLIO

-0.78%

100.00%

At the global portfolio level, this depreciation is partially compensated by:

•

the indexation of the leases;

•

a high occupancy rate: 95.43% at 31.12.2013;

•

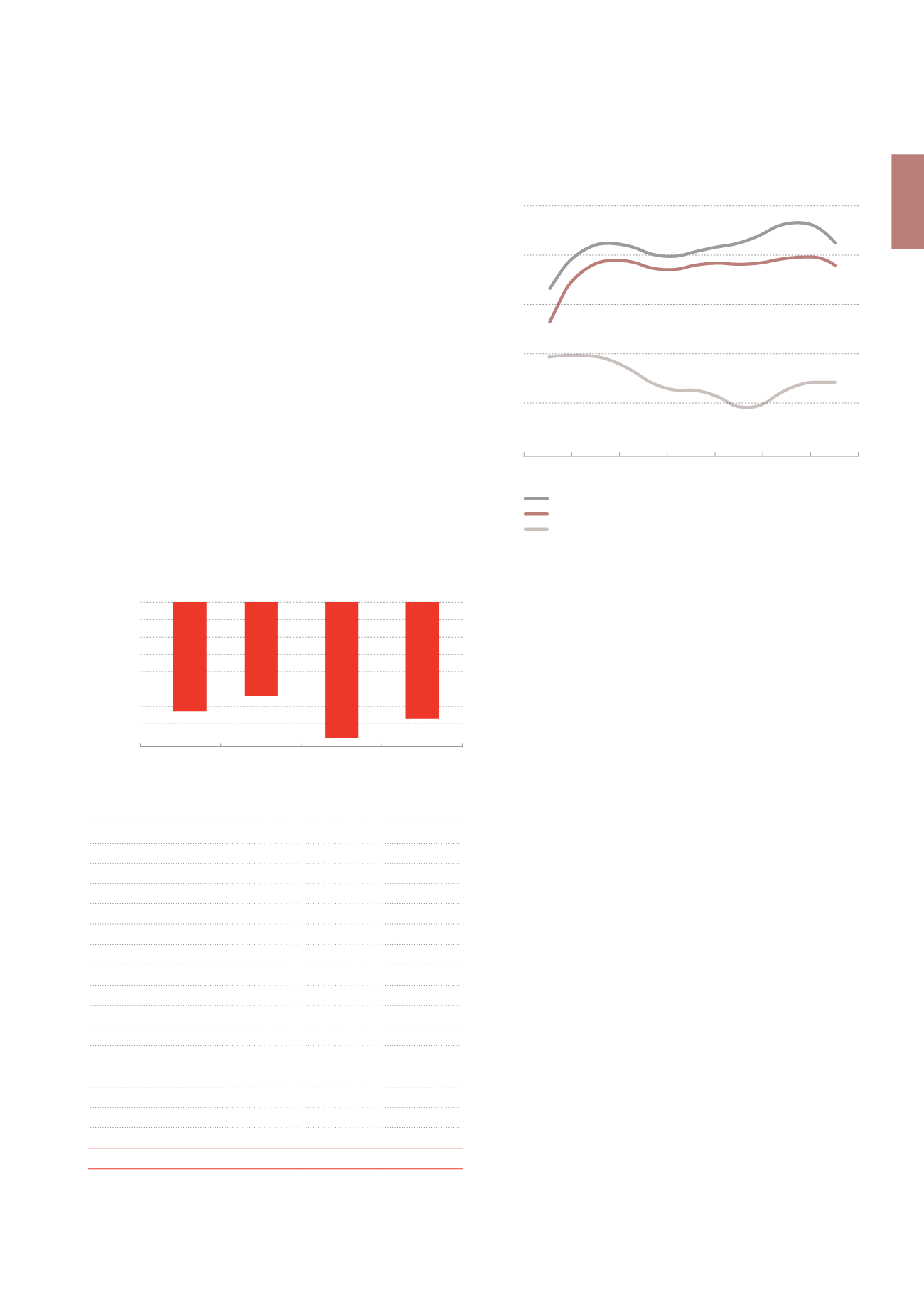

an average residual lease length which has risen from 6.7 years at the

end of 2004, to 8.4 years at the end of 2006, and then to 11.6 years

2

at

the end of 2013, an outstanding figure among the European real estate

companies.

The average residual length of all leases in force at 31.12.2013 is 11.6 years

2

if each tenant was to exercise his first possible termination option. This

number increases to 12.5 years in case no break option was to be exer-

cised and all tenants were to remain in their rented space until the con-

tractual end of the leases.

One of the key features of Sicafis/Bevaks is risk diversification. The

Cofinimmo portfolio is well-diversified, with the largest property represent-

ing only 6.4% of the consolidated portfolio.

Weighted residual lease length

(in number of years)

Global portfolio – Until the end of the leases

Global portfolio – Until the first possible break option

Offices – Until the first possible break option (before 2005,

Cofinimmo only had offices in its portfolio)

1

Including the impact of the investment expenditures capitalised during the year.

2

For the office portfolio alone, it stands at 6.9years.

Changes in the fair value of investment properties

(x €1,000)

0

-1,000

-2,000

-3,000

-4,000

-5,000

-6,000

-7,000

-8,000

Q1

Q2

Q3

Q4

-6,299

-6,694

-5,420

-7,848

\ 25

Global Portfolio

\ Management Report