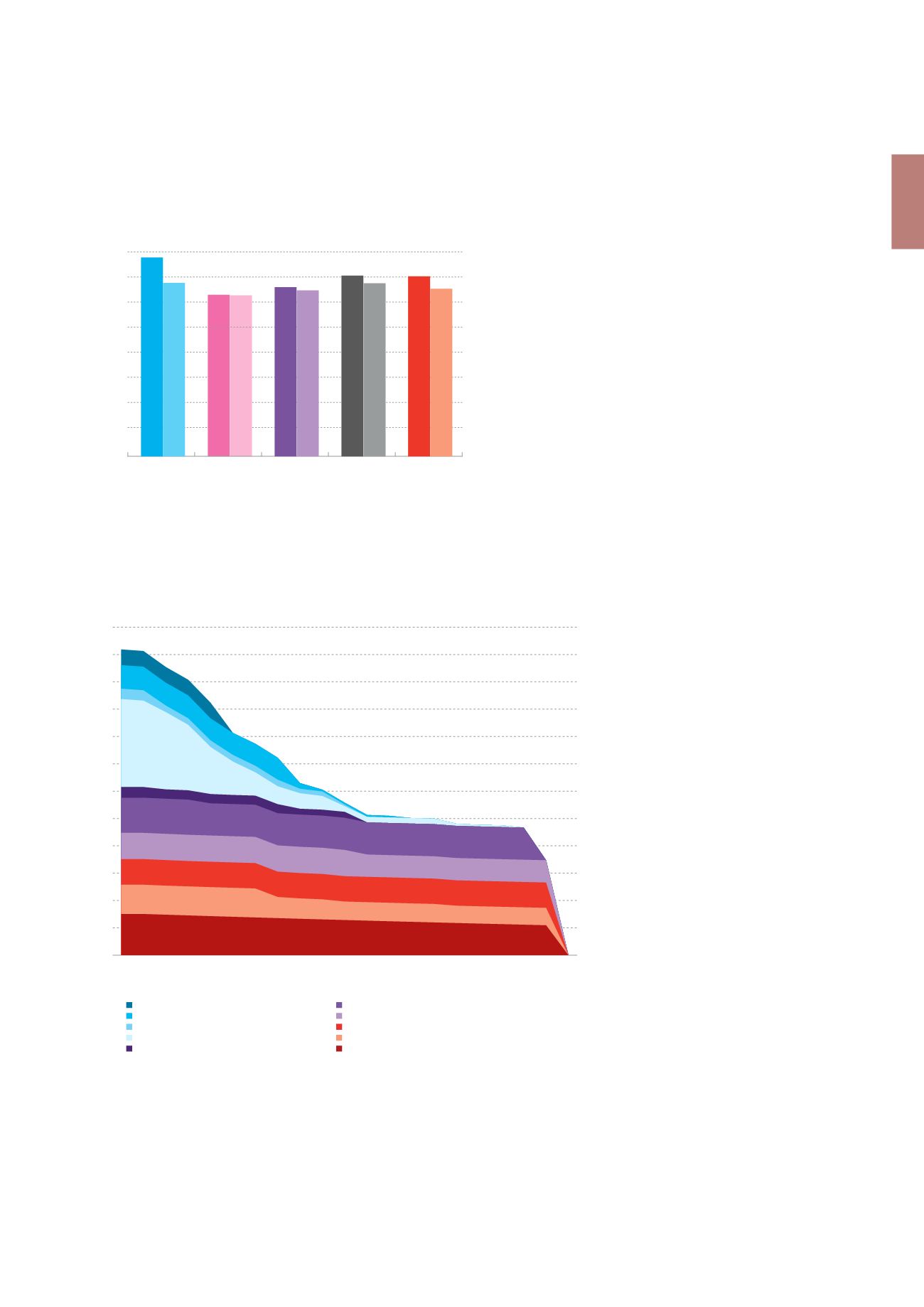

Gross/net rental yields per sector

1

(in %)

Offices

Healthcare real

estate

Property

of distribution

networks

Other

Total

Portfolio

8

7

6

5

4

3

2

1

0

6.31

Brut

6.29

Net

7.77

Brut

6.78

Net

6.61

Brut

6.47

Net

7.06

Brut

6.76

Net

7.03

Brut

6.55

Net

1

If portfolio rented at 100%.

2

Until the first possible break option.

Three elements help to maintain a positive reversion:

•

the office occupancy rate, which is still relatively high (91.24%);

•

the tenant rotation rate over the entire portfolio, which remains

limited at 2%;

•

healthcare real estate and property of distribution networks have

leases which are indexed positively and rents which are protected

by their long duration.

The negative reversion in the office portfolio is due to renegotiations of

contracts.

A minimum of 70% of the rental income is contractually guaranteed until

2019. This percentage increases to 78% in case no termination option is

exercised and all tenants remain in their rented space until the contractual

end of the leases.

Guaranteed rental income

2

- in contractual rents

(x €1,000,000)

AXA Group (offices)

Korian Group (healthcare real estate)

International public sector (offices)

Other tenants (offices)

MAAF

240

220

200

180

160

140

120

100

80

60

40

20

0

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 >2031

0

000000

000000

000000

000000

000000

Buildings Agency (Belgian Federal State) (offices)

Senior Living Group/Medica (healthcare real estate)

Armonea (healthcare real estate)

Other operators (healthcare real estate)

AB Inbev Group

The gross rental yield of the portfolio remains stable at 7.03% (7.01% in

2012).

\ 29

Global Portfolio

\ Management Report