SECTOR INFORMATION

RENTAL SITUATION BY DESTINATION

PROPERTIES

Superstructure

(in m

2

)

Contractuel rents

(x €1,000)

Occupancy

rate

Rents + ERV

1

on unlet

(x €1,000)

ERV

1

(x €1,000)

Offices

519,385

78,980

88.70%

89,042

80,513

Offices of which receivables

have been sold

208,145

26,236

99.83%

26,280

26,280

Subtotal offices

727,530

105,216

91.24%

115,322

106,793

Healthcare real estate

643,755

76,585

99.27%

77,145

74,079

Pubstone (cafés/restaurants)

363,470

30,262

100.00%

30,262

27,306

Cofinimur I (insurance agencies)

59,572

7,892

98.94%

7,976

8,166

Other

23,026

4,285

100.00%

4,285

3,426

Subtotal investment properties

and properties of which

receivables have been sold

1,817,353

224,240

95.43%

234,990

219,770

Projects and renovations

36,114

345

345

Land reserve

145

145

167

GLOBAL PORTFOLIO

1,853,467

224,385

95.43%

235,480

220,282

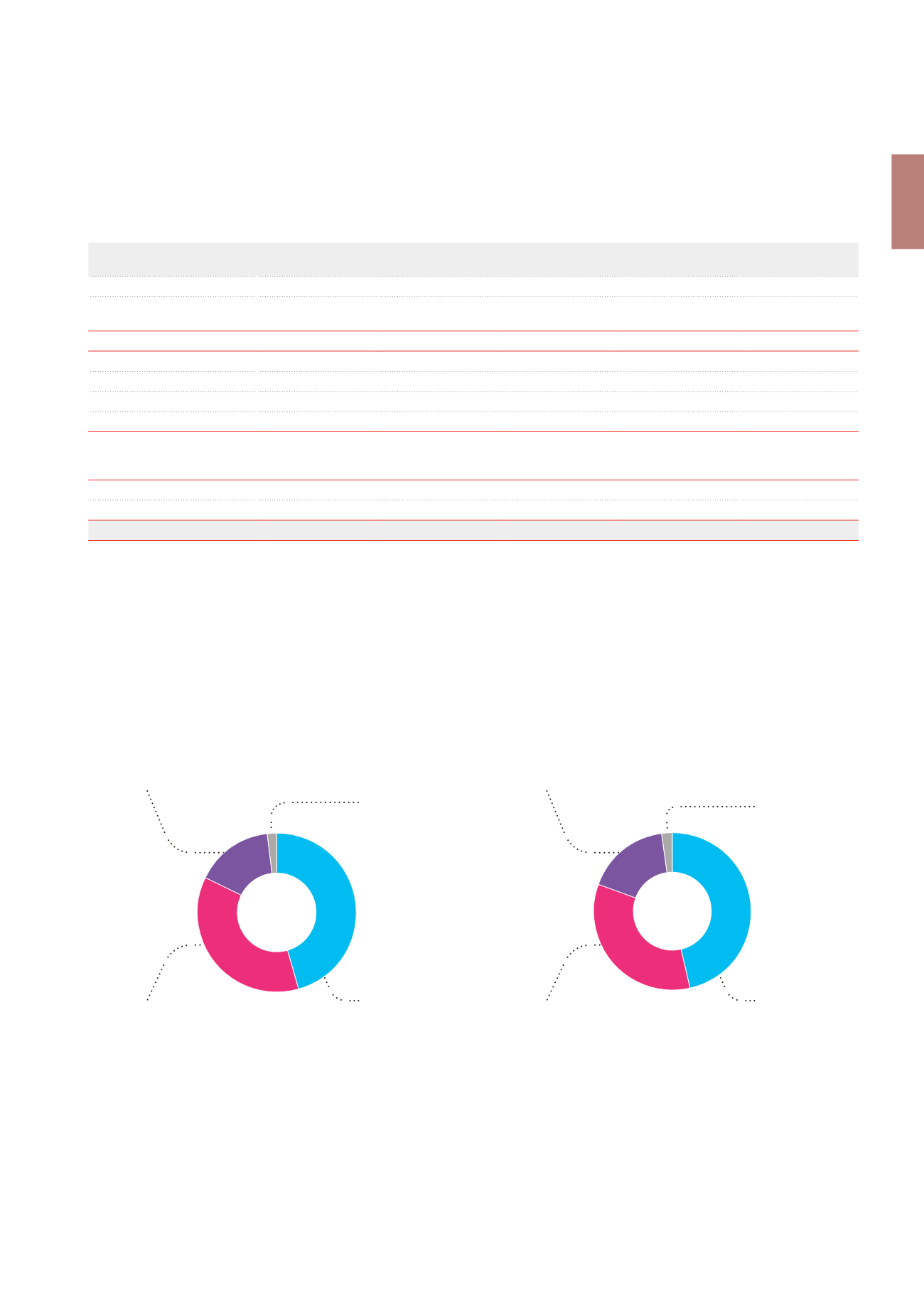

Breakdown by destination - in fair value

2

(in %)

Breakdown by destination - in collected rents

3

(x €1,000)

1

ERV = Estimated Rental Value.

2

For Cofinimmo SA/NV, the breakdown is as follows: Offices 66.1%, Healthcare real estate 31.2%, and Other 2.7%.

3

The difference between the rents actually collected and the contractual rents results from the rent-free periods granted at the beginning of certain leases and the prorata temporis

vacancy of properties during the past 12months.

Offices

45.6%

Offices

102,380

Healthcare real estate

36.7%

Healthcare real estate

75,763

Property of distribution networks

15.9%

Property of distribution networks

37,804

Other

1.8%

Other

4,515

\ 27

Global Portfolio

\ Management Report