1

1

3

3

3

7

2

12

6

6

6

4

2

15

1

10

1

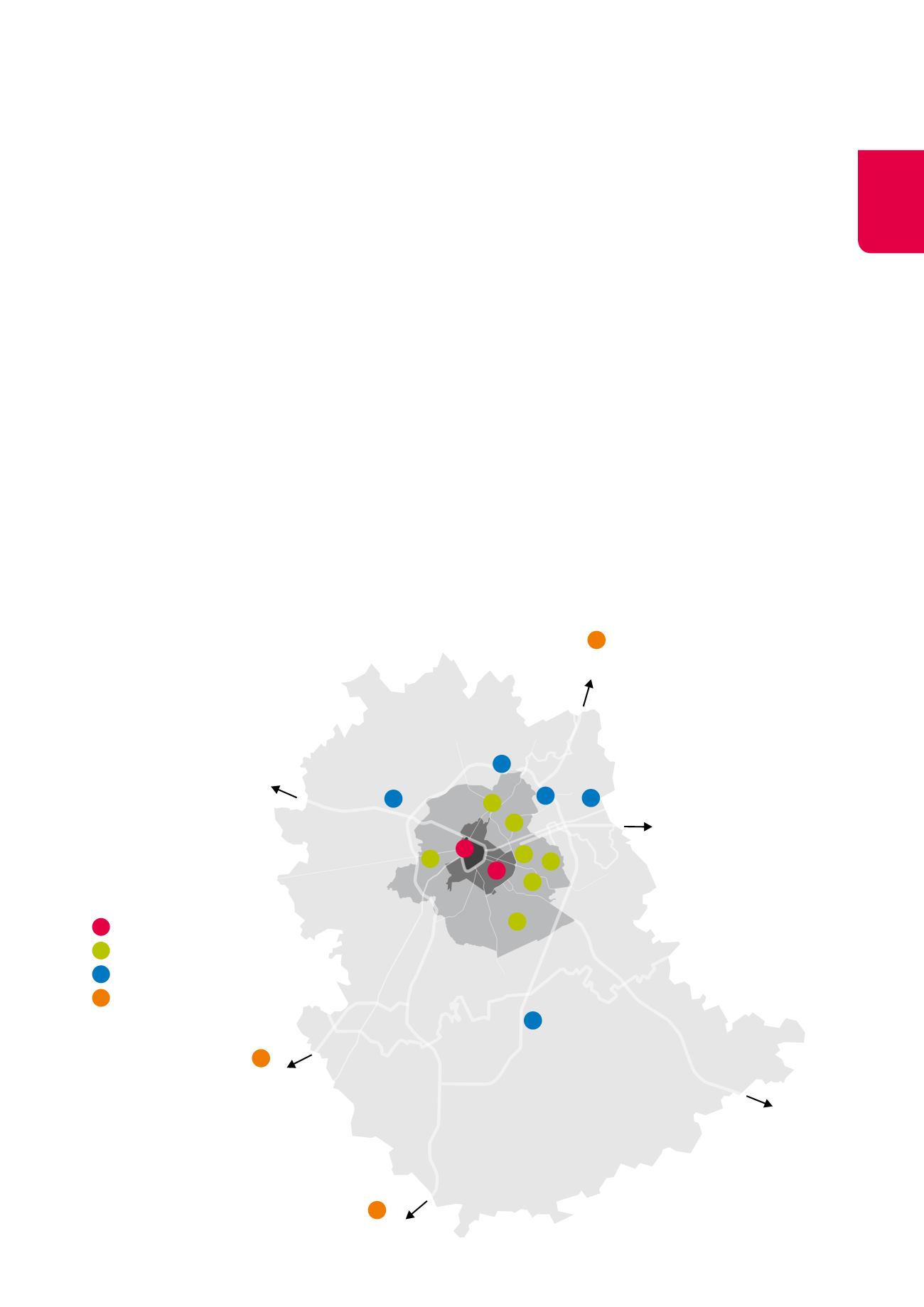

GRIMBERGEN

ASSE

BEERSEL

HALLE

ITTRE

NIVELLES

OTTIGNIES

WAVRE

OVERIJSE

TERVUREN

BRUSSELS

E40

GHENT/

OOSTENDE

E19

ANTWERP

E19

CHARLEROI

A8

TOURNAI

E411

LUXEMBURG

VILVORDE

LEOPOLD

GROOT-

BIJGAARDEN

WATERLOO

BRAINE-L’ALLEUD

DIEGEM

ZAVENTEM

E40

LIEGE/LEUVEN

Market characteristics

The Brussels office market

Sources: CBRE, DTZ, JonesLangLasalle.

Subsegments of the Brussels office market

The Brussels office market has several subsegments. The first four

are often referred to collectively as the Central Business District

(CBD).

Brussels Centre:

the historic city centre

Occupants: Belgian public authorities and medium-sized to large

Belgian private companies.

Leopold District:

the European district of the city

Occupants: European institutions and delegations or associations

collaborating with them.

Brussels North:

business district

Occupants: Belgian and regional public authorities, semi-public

companies and large private companies.

Louise District:

prestigious district

Occupants: law firms, embassies and medium-sized private

companies.

Decentralised Brussels:

the remainder of the 19 municipalities of

the Brussels Capital Region

Occupants: medium-sized to large private companies.

Brussels Periphery & Satellites:

area just outside the Brussels

Capital Region and the Ring

Occupants: private companies of all sizes.

The office rental market in Brussels

Demand

Despite a few hesitant signs of recovery, demand on the Brussels

real estate market reached just 404,000m² in 2014. This level is well

below the average take-up of 500,000m² per year recorded before

the financial crisis.

The public sector accounted for 45% of total rental demand. It was

responsible for the three most important transactions of 2014: the

letting of 46,000m² on the Tour & Taxis site (Brussels North) by the

Flemish Government, that of 36,000m² in the Astro Tower building

(Leopold District) by Actiris (Brussels employment administration)

and that of 17,000m² in Cofinimmo’s Livingstone II building (Leopold

District) by the European Commission. Private sector demand

mainly stems from renegotiations, as occupants whose lease

is due for renewal seize the opportunity to improve their rental

conditions.

More than 25% of rental demand was concentrated in the Leopold

District. A major influence on this trend are the leases by Actiris and

the European Commission mentioned above.

x

x

x

x

Central Business District

Decentralised

Periphery & Satellites

Other

(x = number of properties)

85