1

1

3

3

3

7

2

12

6

6

6

4

2

13

1

10

1

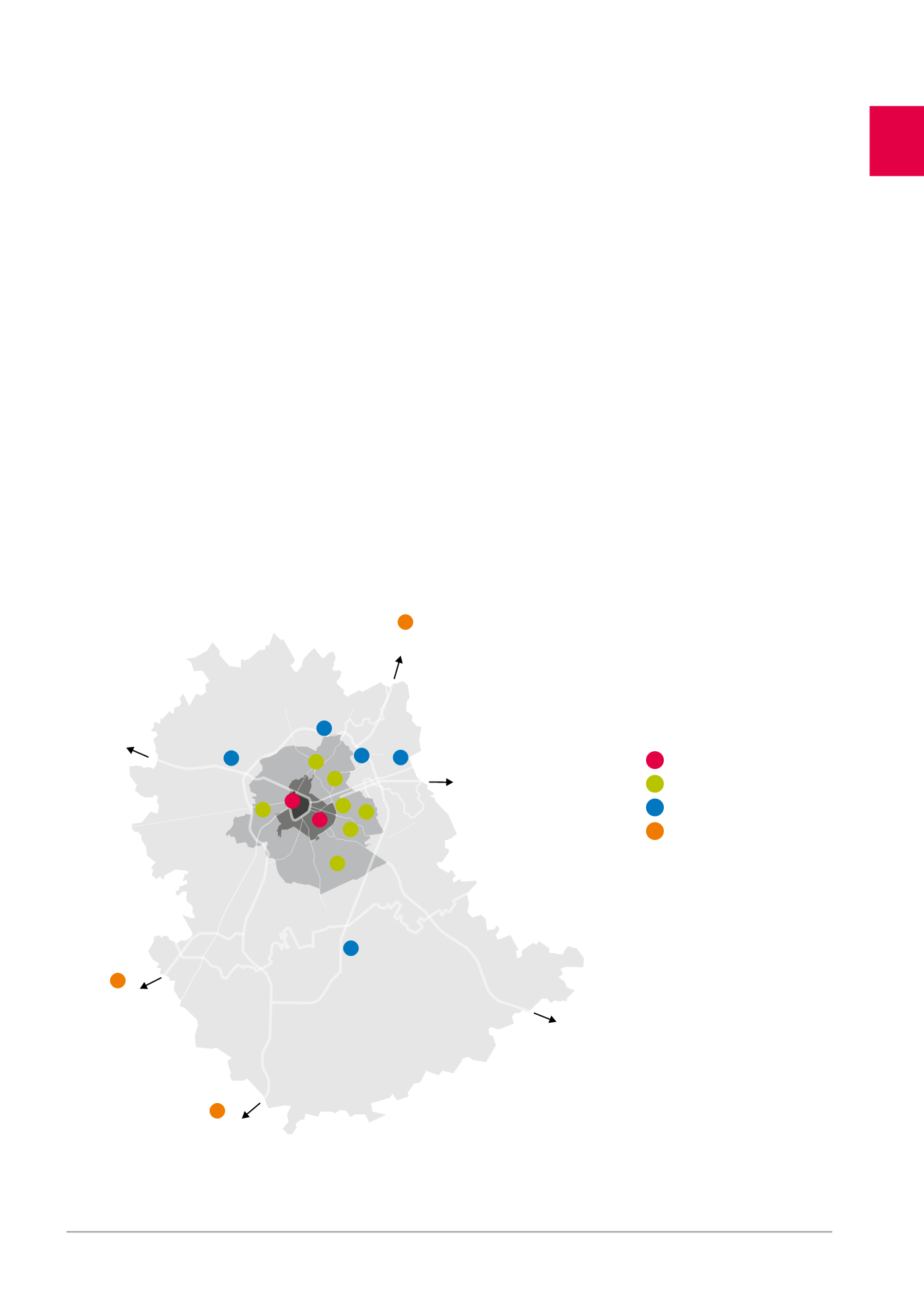

GRIMBERGEN

ASSE

BEERSEL

HALLE

ITTRE

NIVELLES

OTTIGNIES

WAVRE

OVERIJSE

TERVUREN

BRUSSELS

E40

GHENT/

OSTEND

E19

ANTWERP

E19

CHARLEROI

A8

TOURNAI

E411

LUXEMBOURG

VILVOORDE

LEOPOLD

Groot-

Bijgaarden

WATERLOO

BRAINE-L’ALLEUD

DIEGEM

ZAVENTEM

E40

LIÈGE/LEUVEN

x

x

x

x

The office rental market in Brussels

Demand

Despite some timid signs of recovery, rental demand on the Brussels

real estate market reached 325,577 m

2

in 2015, down compared with

2014.

The absence of significant transactions (no transactions above

20,000 m

2

recorded) and a longer decision-making process within

European institutions weighed on letting in 2015. The year’s two largest

transactions are the letting by KPMG of 13,000 m

2

in the PassPort build-

ing and by CPAS de Schaerbeek of 10,000 m

2

in the Silver Building.

The breakdown of rental demand in 2015 was 45% in the CBD, 20% in

Decentralised Brussels and 35% in the Brussels Periphery.

Supply

During financial year 2015, 64,074 m² in new office space was delivered

on the Brussels market. There were few speculative investments,

which confirms the trend observed since 2011 of an extremely low

volume of “risky” deliveries.

In 2016, 134,000 m

2

of space is expected on the market, including

100,000 m

2

already pre-let.

Vacancy

In 2015, the rental vacancy on the Brussels office market decreased

slightly, from 10.6% at 31.12.2014 to 10.1% at 31.12.2015. This decline is

explained by the small quantity of new speculative buildings placed

on the market and the conversion of office buildings to other uses

(residential, hotel, nursing home, etc.).

The disparities between districts are significant. The CBD has a “stable”

vacancy rate of 6.9%, whereas the periphery struggles to reduce its

vacancy rate, which is still 16%. Furthermore, there are also disparities

between building types, with “Grade A”

1

buildings being the most in

demand.

The Brussels office property investment market

In 2015, 1.1 billion EUR was invested in the office segment in Brussels.

Prime yields for offices in Brussels remain under pressure: at the end

of 2015, they amounted to 5.25% for assets let under a 3/6/9 lease and

below 5% for assets under long-term leases.

1

Grade A: new development or renovation according to the latest standards, including sublet spaces in new/renovated buildings which have not been previously occupied.

Central Business District

Decentralised

Periphery & Satellites

Other

(x = number of establishments)

95