The borrowed capital can be a cheaper source of financing than

shareholders’ equity. Short- and long-term financial commitments

require active management.

The three-strong treasury department is responsible for manag-

ing this debt. It also implements the company’s hedging policy to

limit risk of a change in interest rates on borrowed capital and so

optimise its cost.

Cofinimmo seeks to diversify its funding sources in order to

achieve the right balance between the cost and sustainability of

funding sources.

In the past ten years, the company has raised an average of nearly

€260 million a year on the capital markets, both the debt market

and the stock market.

In 2015, Cofinimmo will continue its diversification policy to ensure

the growth in its income and stability of its dividends.

Borrowed capital

Cofinimmo has taken measures to enhance the liquidity of its

shares. It has carried out multiple specific campaigns towards

institutional and private investors (roadshows, conferences…) in

order to reinforce the company’s reputation.

Enhancing the liquidity of the share

Current earnings

per share

€6.70

NAV

(in fair value)

per share

€85.80

2014 dividend

per ordinary

share

€5.50

Average

cost of debt

3.4%

Performance indicators

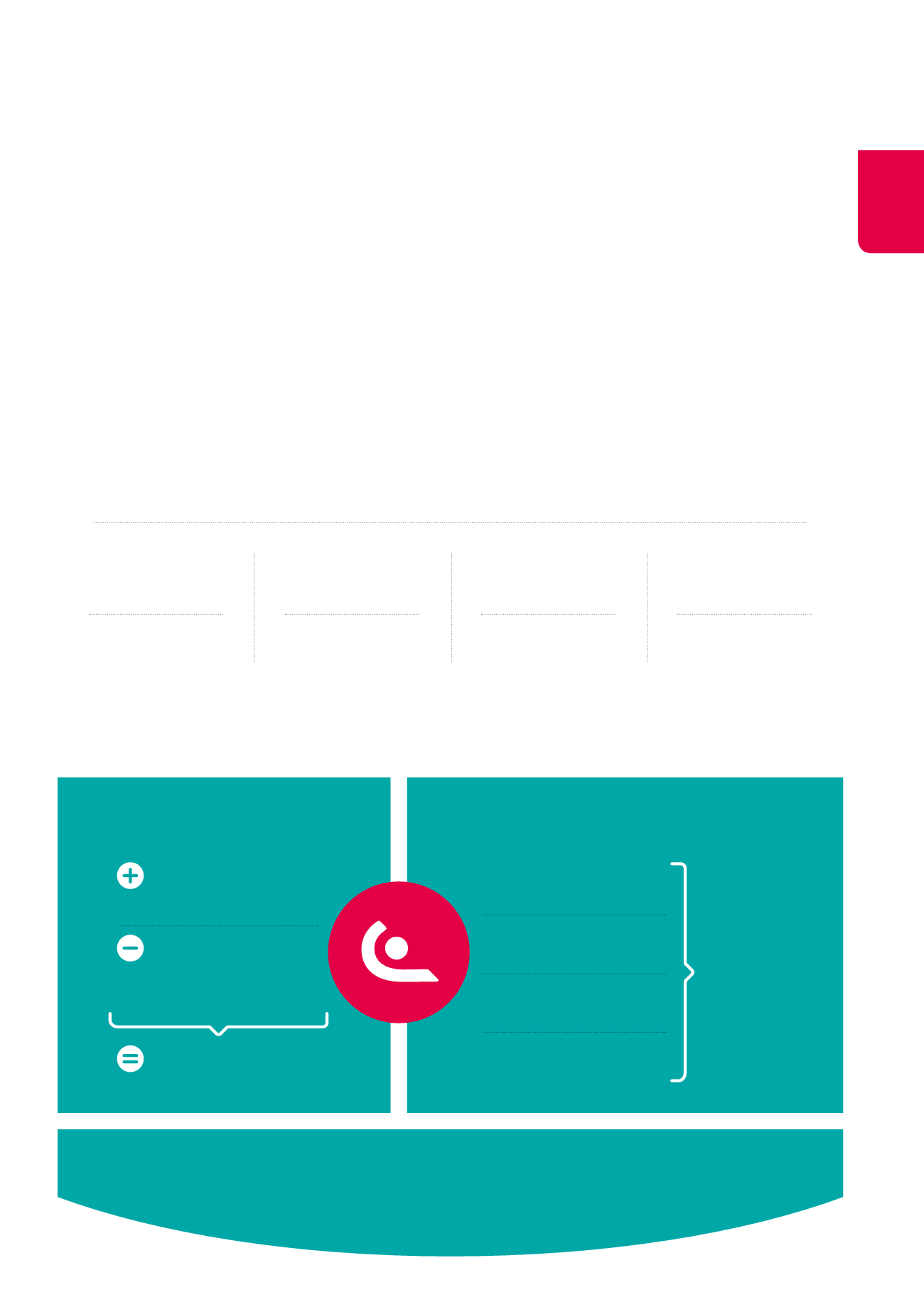

Direct economic value generated and

distributed for 2014 (2013) (x €1,000)

Total economic

value

distributed

€-152,493

Clients

€205,692

Suppliers of goods

and services

€-19,948

Value added

€185,744

Economic value generated

Human resources

€-14,442

Shareholders

€-76,467

Financial expenditure

€-57,009

Public sector

€-4,575

Economic value distributed

€33,251

Economic value retained within the Group

21