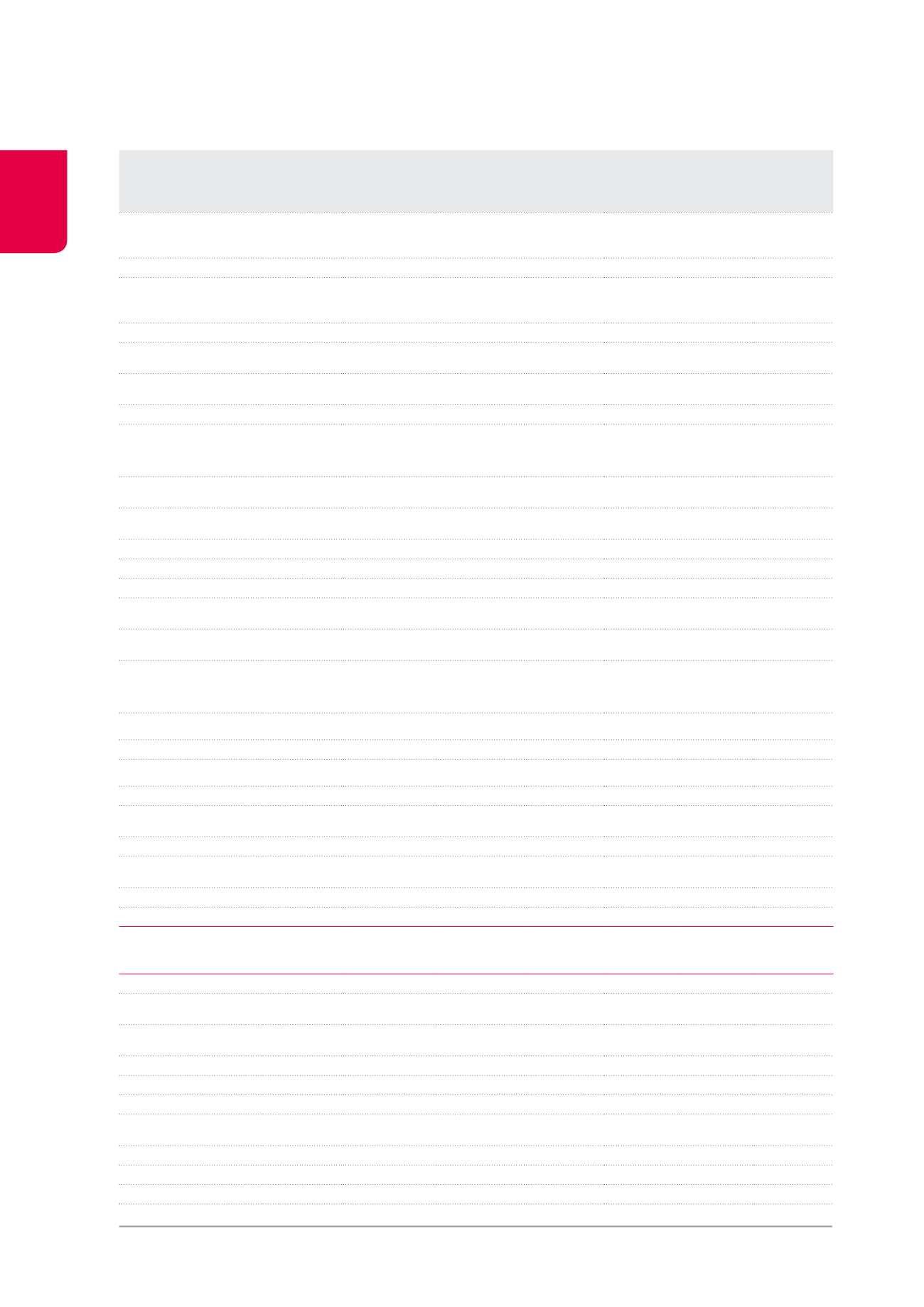

Property

Year of con-

struction/last

renovation

(extension)

Superstructure

(in m²)

A

Contractual

rents

(x €1,000)

C=A/B

1

2014

Occupancy

rate

B

Rents + ERV

on unlet

(x €1,000)

Estimated

rental value

2

(x €1,000)

Operators :

Stichting Sozorg & Martha Flora

3,074

470

100%

470

488

DE RIDDERVELDEN - GOUDA*

2014

3,074

470

100%

470

488

Operator:

Stichting Zorggroep Noordwest-Veluwe

3,887

560

100%

560

560

ARCADE NW - ERMELO *

2014

3,887

560

100%

560

560

Germany

4,637

833

100%

833

833

Operator: Celenus

4,637

833

100%

833

833

BADEN-BADEN*

2005

4,637

833

100%

833

833

Property of distribution networks

420,755 37,585

98% 38,196 35,717

Pubstone

360,887

29,854

99%

30,166

27,406

Pubstone Belgium (800properties)*

312,810

19,583

99%

19,777

18,229

Brussels

40,758

3,605

100%

3,605

3,362

Flanders

197,076

11,600

99%

11,728

11,242

Wallonia

74,977

4,378

99%

4,444

3,625

Pubstone Netherlands (245properties)*

48,077

10,270

99% 10,389

9,177

Cofinimur I (280properties)*

59,868

7,731

96%

8,030

8,311

Others

23,026

4,301

100% 4,308

4,100

Antwerp Periphery

61

0

0%

7

7

NOORDERPLAATS (AMCA)

2010

61

0

0%

7

7

Brussels Decentralised

7,196

2,464

100%

2,464

2,464

SOMBRE/DONKER 56

2004 (2012)

7,196

2,464

100%

2,464

2,464

Brussels Periphery

6,124

570

100%

570

398

MERCURIUS 30

2001

6,124

570

100%

570

398

Other regions

9,645

1,267

100%

1,267

1,231

KROONVELDLAAN 30 - DENDERMONDE

2012

9,645

1,267

100%

1,267

1,231

TOTAL INVESTMENT PROPERTIES &

OFFICES WHICH RECEIVABLES HAVE BEEN

SOLD

1,744,821

211,916

95.19% 222,628

217,259

Land reserve offices

125

125

152

Brussels Centre & North

3

3

3

DE LIGNE

3

3

3

MEIBOOM 16-18

0

0

0

PACHECO 34

0

0

0

Brussels Leopold & Louise Districts

2

2

2

LOUISE/LOUIZA 140

0

0

0

MONTOYER 14

2

2

2

MONTOYER 40

0

0

0

PROPERTY REPORT /

Consolidated property portfolio

1

The occupancy rate is calculated as the contractual rents divided by the sum of

the rents + the ERV of unlet spaces.

2

The determination of the estimated rental value takes into account market data,

the location of the asset, the quality of the building, the number of beds for

healthcare facilities and, if available, financial data (EBITDAR) from the tenant.

94